Member Online Services User Guide

Table of Contents

1.1 What You Will Be Able To Do

2.1 Registering for Member Online Services (MOS)

2.5 Recovering a Lost User ID or Password

5.1.1 Navigating to the Contact Information Screen

5.1.2 Changing Your Phone Number/Email Address

5.1.3 Viewing Previous Email Address/Phone Number Changes

5.1.4 Changing Your Mailing Address

5.1.5 Adding an Alternate Address

5.2.1 Navigating to the Member Correspondence Screen

5.2.2 Viewing Available Information about Member Correspondence

5.2.3 Uploading Documents to the RSA

5.3 Change User ID/Password/Secret Question

7.3.1 Navigating to the Direct Deposit Screen

7.3.2 Viewing Your Direct Deposit Information

7.4.1 Navigating to the Tax Information Screen

7.4.2 Viewing the Tax Information Screen

7.4.3 Changing Your Tax Withholdings

7.4.4 Viewing Tax Withholding Changes

The Retirement Systems of Alabama (RSA) Member Online

Services (MOS) website allows Retirees convenient 24 hours a day, 7 days

a week access to their retirement account information. It is a secure

site enabling members to view their retirement account information such

as benefit payment history, account summary, and other relevant details

specific to their account. In addition, members can update their address

and contact information on record with the RSA, view direct deposit information,

as well as change their tax withholding information. This tool provides

Retirees with selected access to their retirement account information.

The MOS website reduces the amount of data entry activities for the RSA

staff since Retirees are able to update their retirement account information

online.

1.1 What You Will Be Able To Do

At the end of this training, you will be able to:

· Register as a new user

· Maintain user id, password, and secret question credentials for logging in

· Maintain address and contact information

· View and upload member correspondence

· Navigate the secure message center and submit a question

· View account summary information

· View payment history information

· View direct deposit information

· View

and maintain tax information

The instructions in this guide assume you know the basics of navigating within a browser based system.

Note: Information in this user guide contains fictitious data.

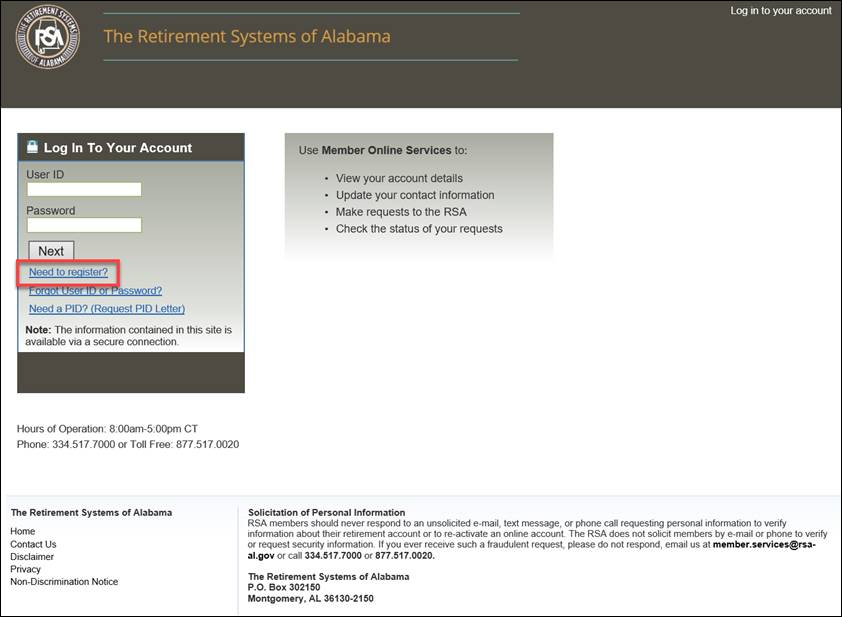

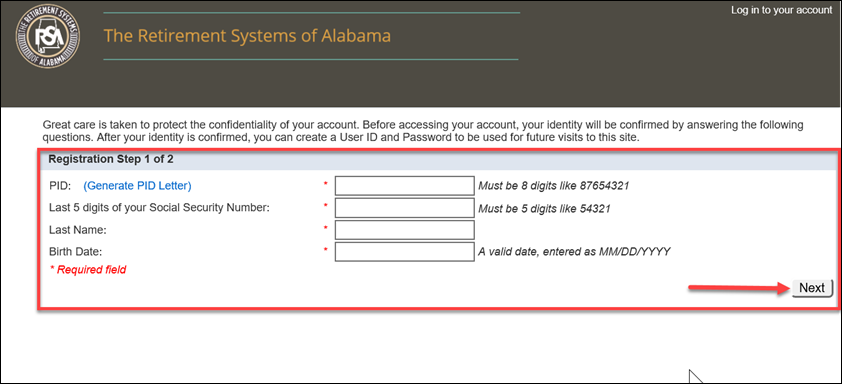

The Login screen is the starting point for you to access the MOS website, but before you login for the first time, you must register. To register for a MOS account, you need to follow the steps outlined here and enter all required information on each screen. If you do not enter the required information, you will not be able to successfully register on the MOS website. If you incorrectly enter information 10 consecutive times, such as your PID, last 5 digits of your Social Security Number, Last Name, or DOB, the registration process will be locked. If your account is locked, you will need to contact the RSA to unlock it.

2.1 Registering for Member Online Services (MOS)

Step 1 -- From the RSA website (http://www.rsa-al.gov), click the MOS Login link to access MOS (Member Online Services).

Step 2 -- Click on the link called Need to register?.

Step

3 -- Enter

PID, Last 5 digits of your Social Security Number, Last

Name, and Birth Date on the registration page and click ![]() .

.

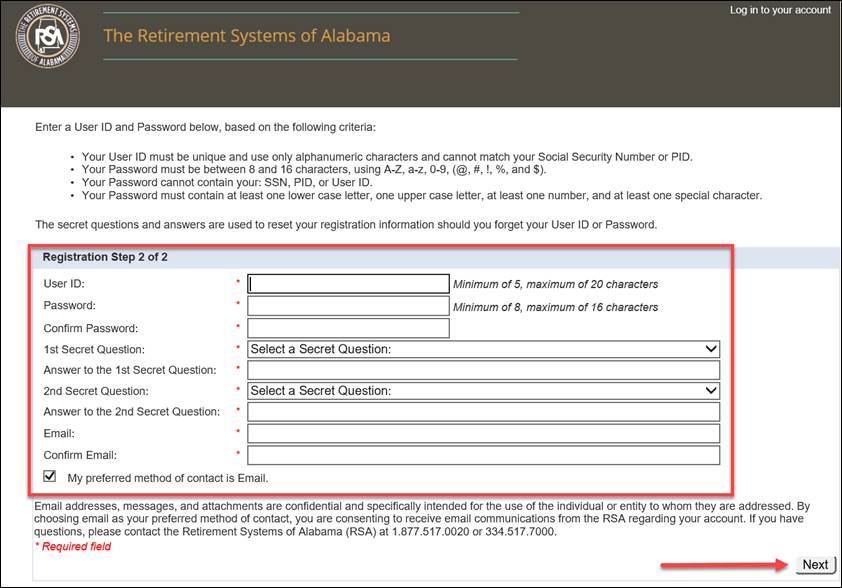

Step 4 -- Enter

a User ID, Password, Confirm Password, select a 1st

Secret Question and an Answer, select a 2nd

Secret Question and an Answer, enter an Email address,

Confirm Email, and then click ![]() .

.

Note: Your User ID must be unique and use only alphanumeric characters and cannot match your Social Security Number or PID

Note: Your Password is case sensitive and must be between 8 to 16 characters using characters A-Z, a-z, 0-9, @, #, !, %, and $.

Note: Passwords cannot contain your Social Security Number, PID, or User ID.

Note: Passwords must contain at least 1 upper case letter, 1 lower case letter, 1 number, and 1 special character.

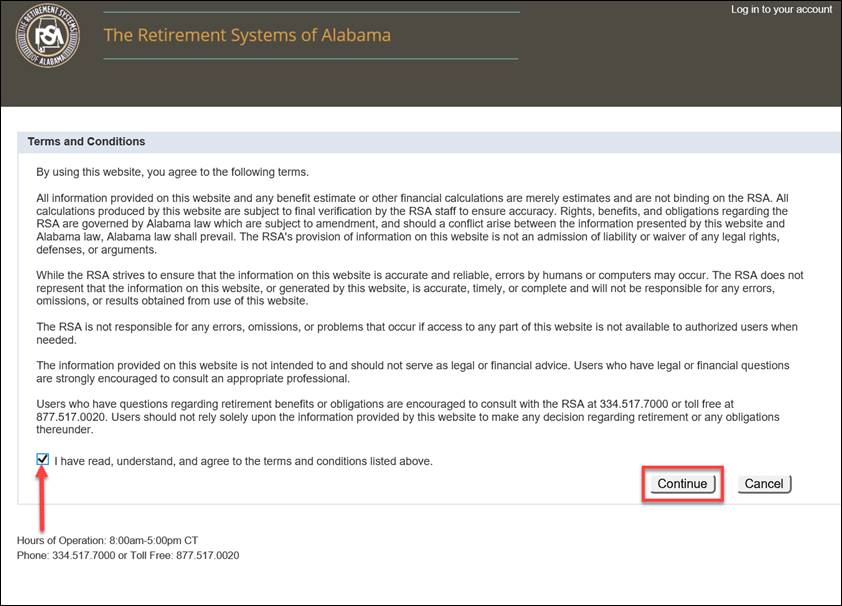

Step

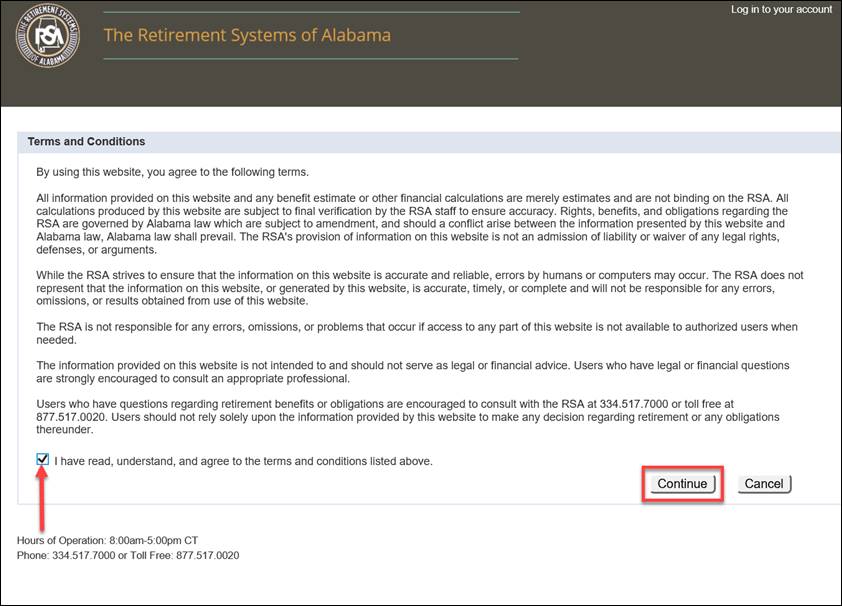

5 -- Read

the Terms and Conditions section. Click the checkbox to confirm

that you have read, understand, and agree. Then click ![]() .

.

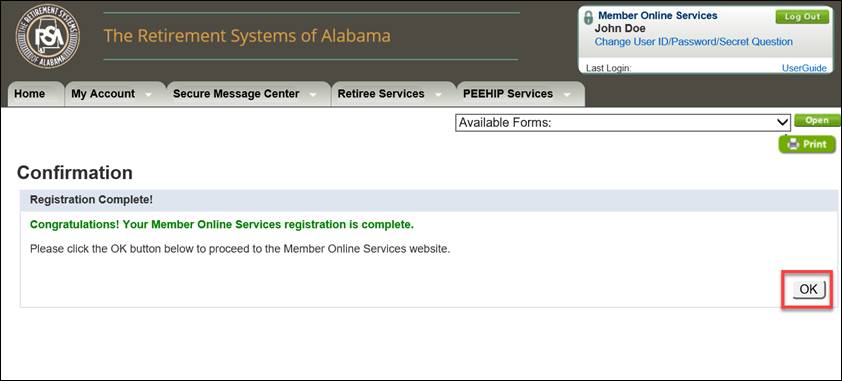

Step

6 -- A

confirmation message is displayed on the screen. Click ![]() .

.

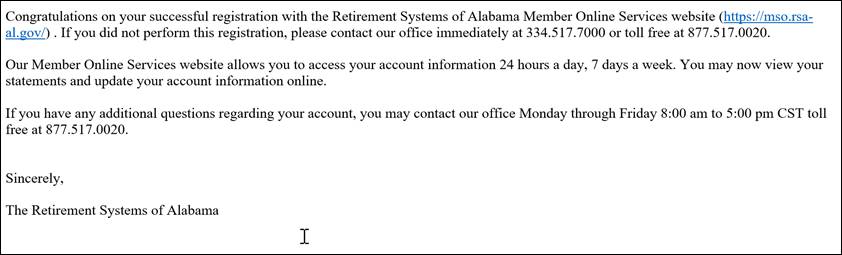

Step 7 -- A MOS Registration email is sent to the retiree.

Note: A registration confirmation letter (RSA-586) will be mailed upon the member’s initial registration only.

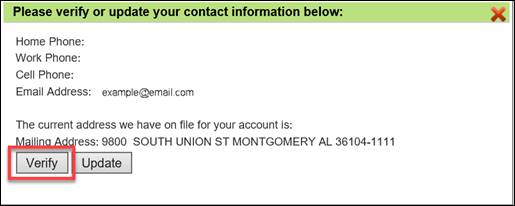

Step

8 -- A

pop-up window displays asking you to verify your contact information.

If you need to make changes, click ![]() and

you will be taken to the Contact Information screen (described

later in this guide). If the information is accurate and no changes are

needed, click

and

you will be taken to the Contact Information screen (described

later in this guide). If the information is accurate and no changes are

needed, click ![]() .

.

Step 9 -- You are then logged into the system. The Home page displays.

After you register for a MOS account, you can use your User ID and Password to log into the MOS website 24 hours a day, 7 days a week to access your account information. The following steps describe how to log into the MOS website.

Note: If you try to log in 10 consecutive times with the incorrect User ID, Password, or security question your account will be locked. If your account is locked, you will need to contact the RSA to unlock it. The RSA will reset your account access and you will have to re-register on MOS.

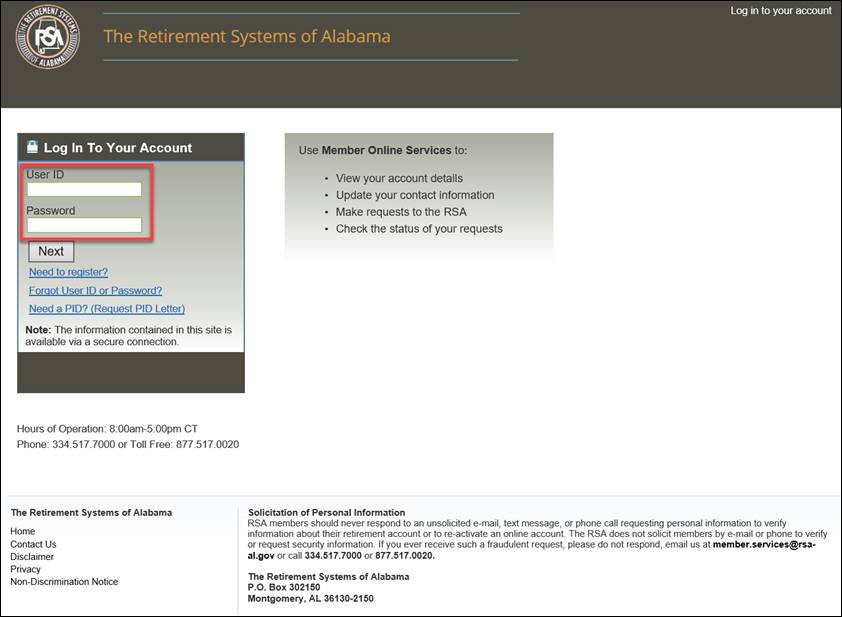

Step

1 -- From

the Login In To Your Account section, enter your User ID

and Password into the fields. Then click ![]() .

.

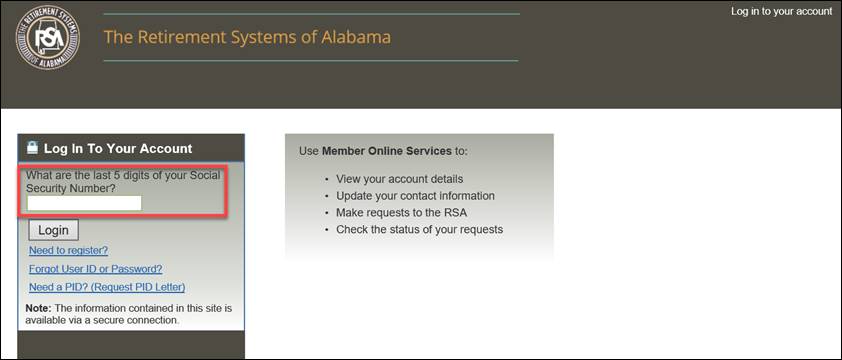

Step

2 -- Answer

the security question. The security questions display randomly and can

be one of the following: the Last 5 digits of the SSN (99999), Birth Date

(MMDD), Birth Date (YYYY), or Zip Code (99999). Then click ![]() .

.

Step

3 -- Read

the Terms and Conditions section. Click the checkbox to confirm

that you have read, understand, and agree. Then click ![]() .

.

Step 4 -- The system verifies that the credentials entered are valid. You are redirected to the Home tab if the credentials are valid.

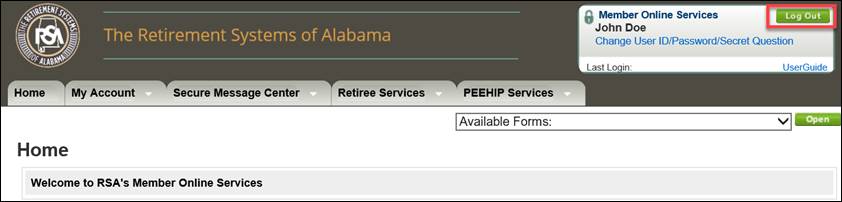

The logout feature allows you to leave the MOS

website securely. When you are logged out, you cannot access any of the

screens within the MOS website. The Log Out button (![]() )

appears in the top right-hand corner of every screen on the MOS website.

)

appears in the top right-hand corner of every screen on the MOS website.

Step 1 -- Click

![]() .

.

As a measure of security, the MOS website contains a timeout feature. If there is no activity (i.e., not taking actions such as saving, navigating to different pages, or confirming information) performed on the website for 15 minutes or if you close your browser window, you will automatically be logged out of the website and returned to the Login screen. A pop-up appears after two minutes of inactivity that asks if you want to continue or logout. In order to log back into the MOS website, re-enter your User ID and Password and answer one of the security questions.

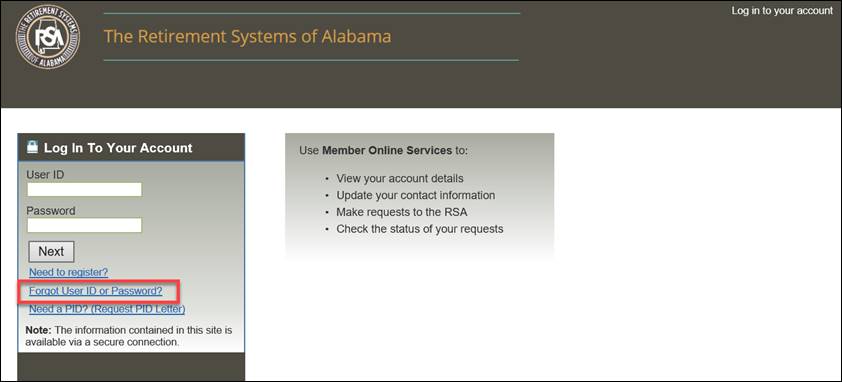

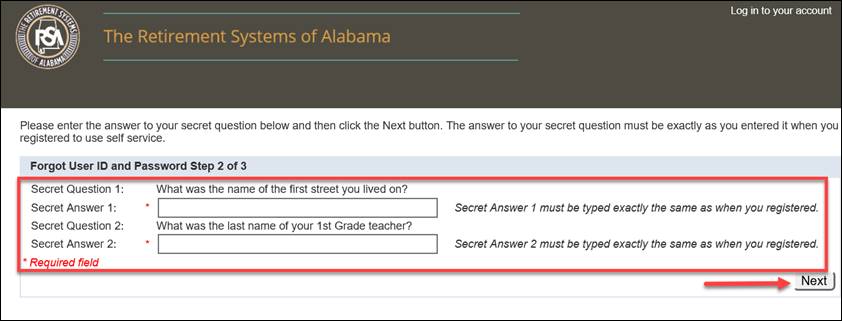

2.5 Recovering a Lost User ID or Password

If you forget your User ID or Password, you are able to obtain a new one by clicking on the Forgot User ID or Password link on the Login screen and follow the steps below. You must enter all required information on each screen. If you do not enter required information, you will not be able to successfully recover your lost User ID or Password.

Step 1 -- Navigate to the Login screen of the MOS website. Click on the link called, Forgot User ID or Password?.

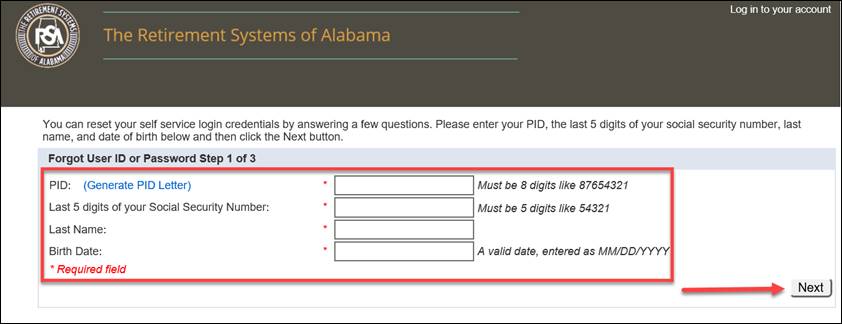

Step

2 -- Enter

your PID, Last 5 digits of your Social Security Number,

Last Name, Birth Date, and click ![]() .

.

Step 3 -- Enter

the answers to Secret Question 1 andSecret Question 2 and

click ![]() .

.

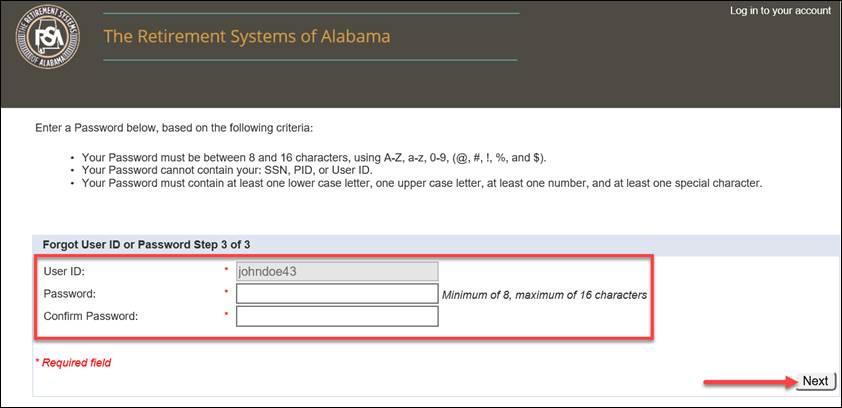

Step

4 -- The

system populates the User ID in the User ID field. Enter a new

password in the Password field, if needed. Re-enter the password

in the Confirm Password field to confirm the password was entered

correctly. Then click ![]() .

.

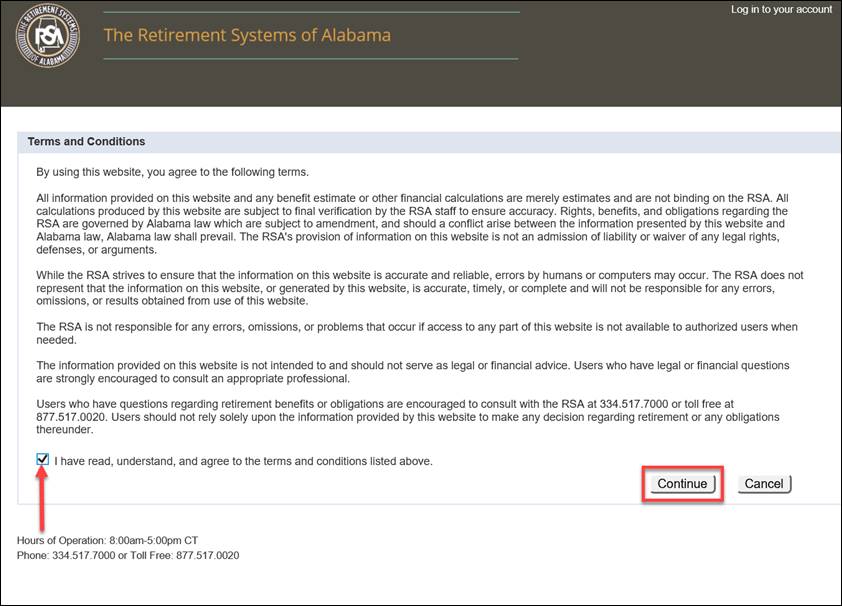

Step

5 -- Read

the Terms and Conditions section. Click the checkbox to confirm that you

have read, understand, and agree. Then click ![]() .

.

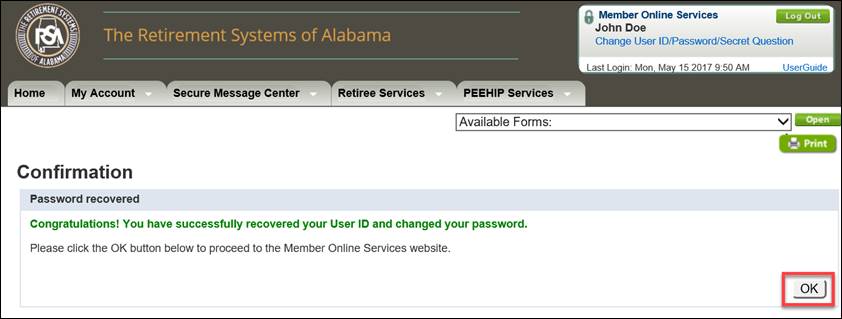

Step

6 -- A

confirmation message appears. Click ![]() .

.

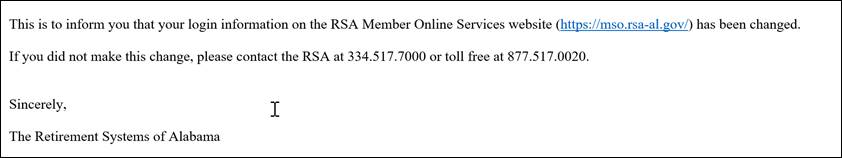

Note: A correspondence (RSA-N847) User ID / Password Change email is generated.

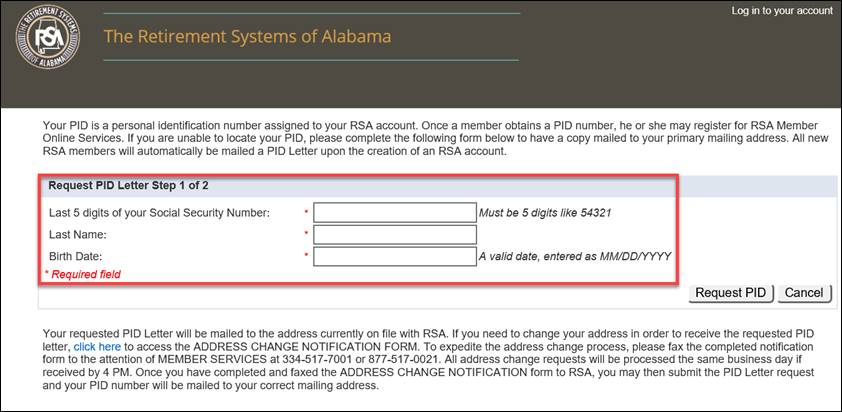

Retirees can request a PID letter from the RSA if they do not already know their PID. This can be done from either the Login screen or during registration. You will need to verify the Last 5 digits of your SSN, Last Name, and Date of Birth. If all of the entered information is correct, a letter with your PID will be mailed to your address on record with the RSA within one business day.

To request a letter with your PID information follow the steps below:

Step 1 -- Navigate to the Login page of the MOS website. Then, click on the link called Need a PID? (Request PID Letter).

Step 2 -- Enter information in the required fields (Last 5 digits of your Social Security Number, Last Name, and Birth Date).

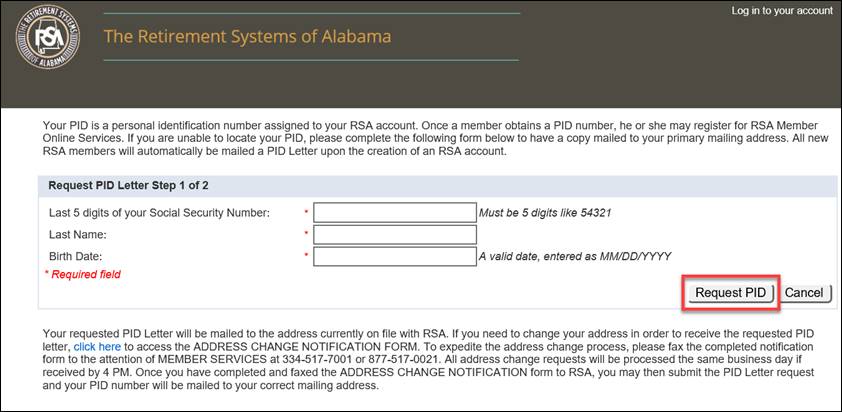

Step 3 -- Click

![]() .

.

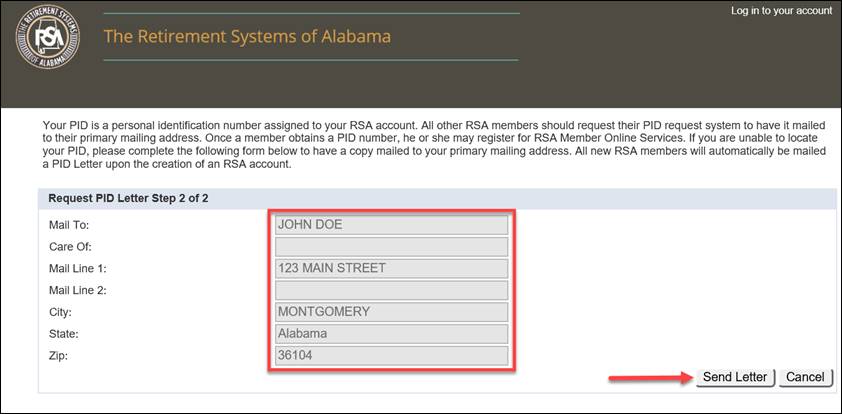

Step 4 -- The

screen displays your address of record with the RSA. Click ![]() .

.

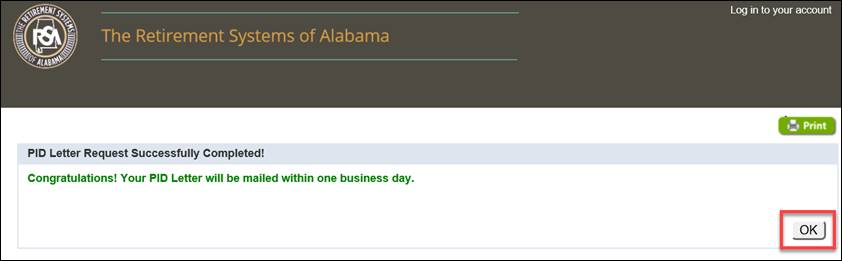

Step 5 -- A

confirmation message appears indicating your PID Letter Request was sent.

Click ![]()

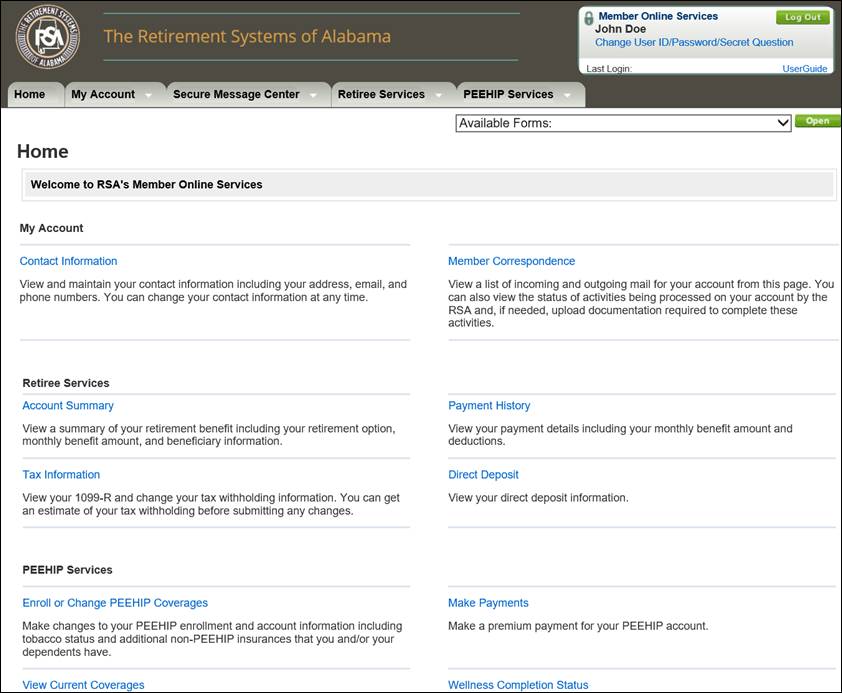

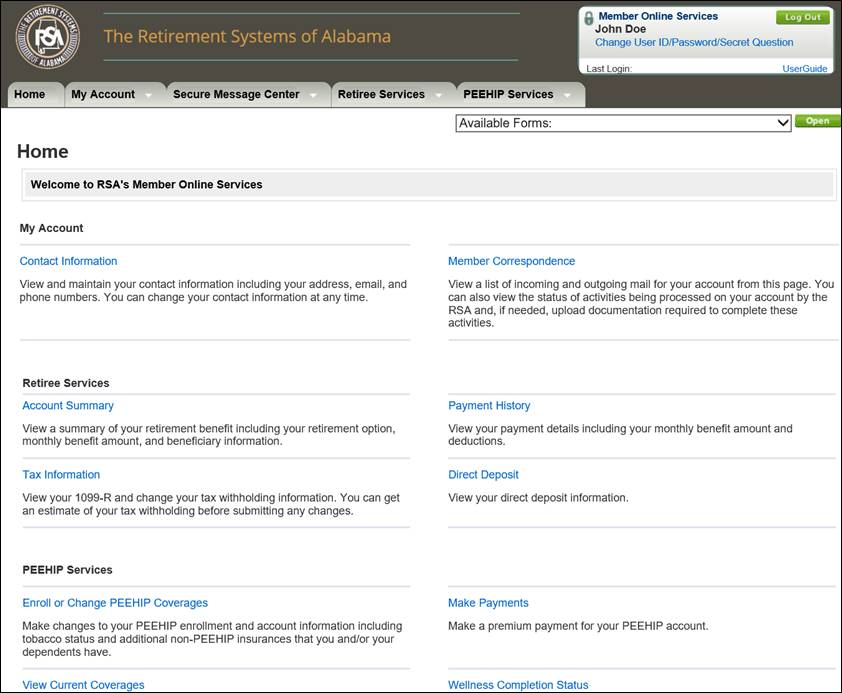

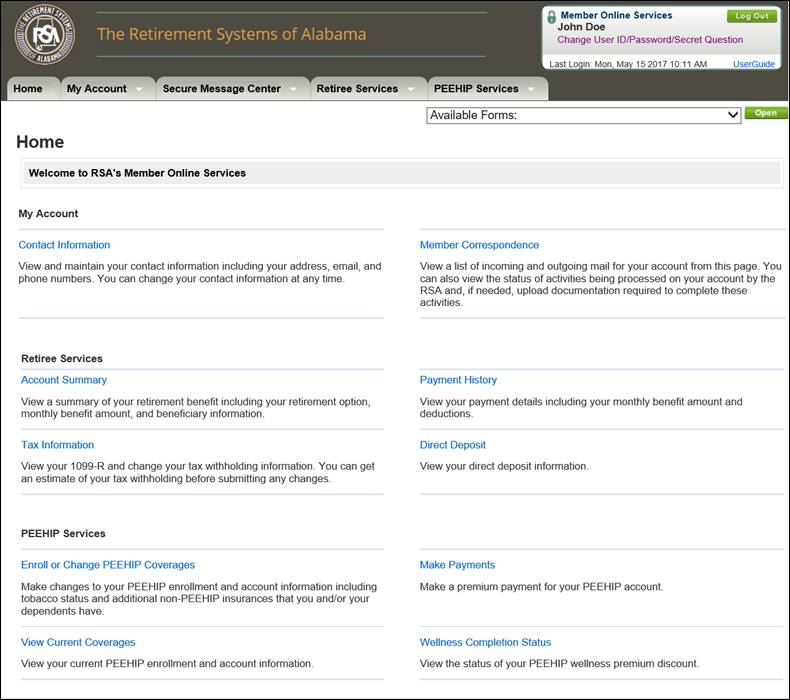

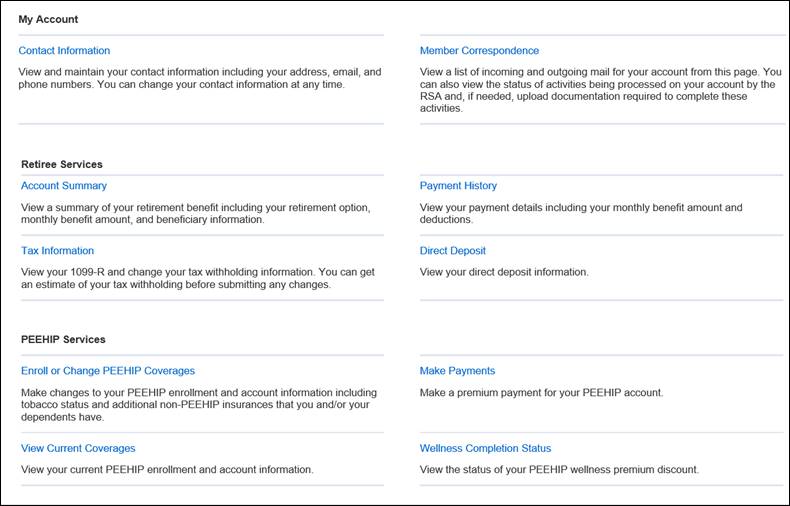

After logging into the MOS website, the Home screen displays.

From the Home screen, you can navigate to different sections of the website by clicking on the links in the lower portion of the screen. The contents on the Home screen are dynamic based on the user that is logged in.

You are also able to access these screens from the drop-down menus at the top of the Home screen. These menus are available on every screen within the MOS website.

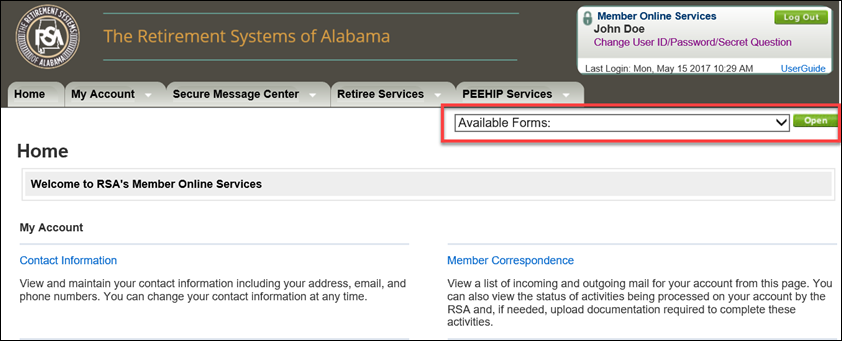

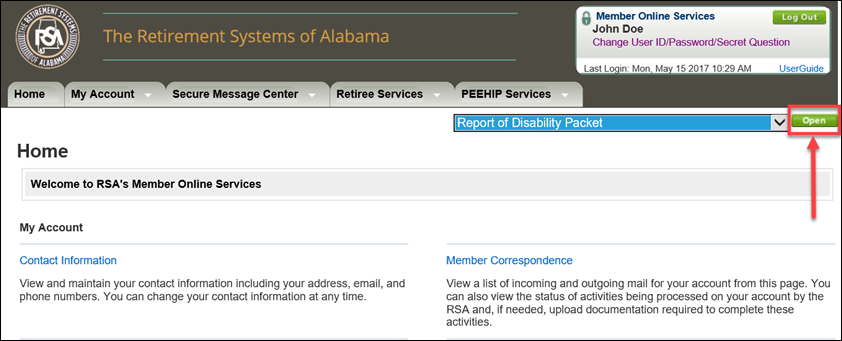

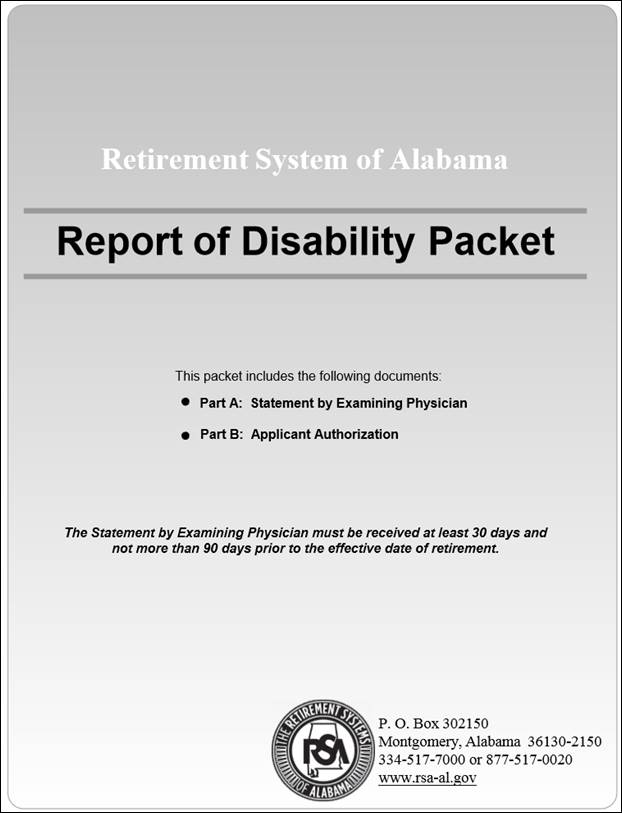

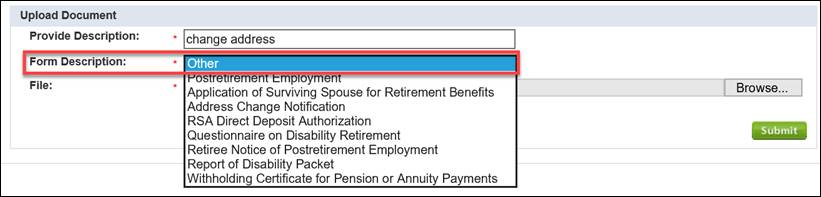

Using the MOS website, you can view and print electronic versions of forms. The following represent some of the available forms, which vary based on the user logged in:

· Address Change Notification

· Application of Surviving Spouse for Retirement Benefits

· Postretirement Employment

· Questionnaire on Disability Retirement

· Report of Disability Packet

· Retiree Notice of Postretirement Employment

· RSA Direct Deposit Authorization

· Withholding Certificate for Pension or Annuity Payments

After printing and entering information into

the form, you must mail the form to the RSA for staff to process it.

Step 1 -- The Available Forms drop-down menu is available on the right side of the screen.

Step 2 -- Select the form you want to view from the Available Forms drop-down menu.

Step 3 -- Click

![]() .

.

Step 4 -- An electronic version of the selected form displays and is pre-populated with your information and a bar code that will allow the RSA to process it in a more efficient manner. This form must be printed and mailed to the RSA.

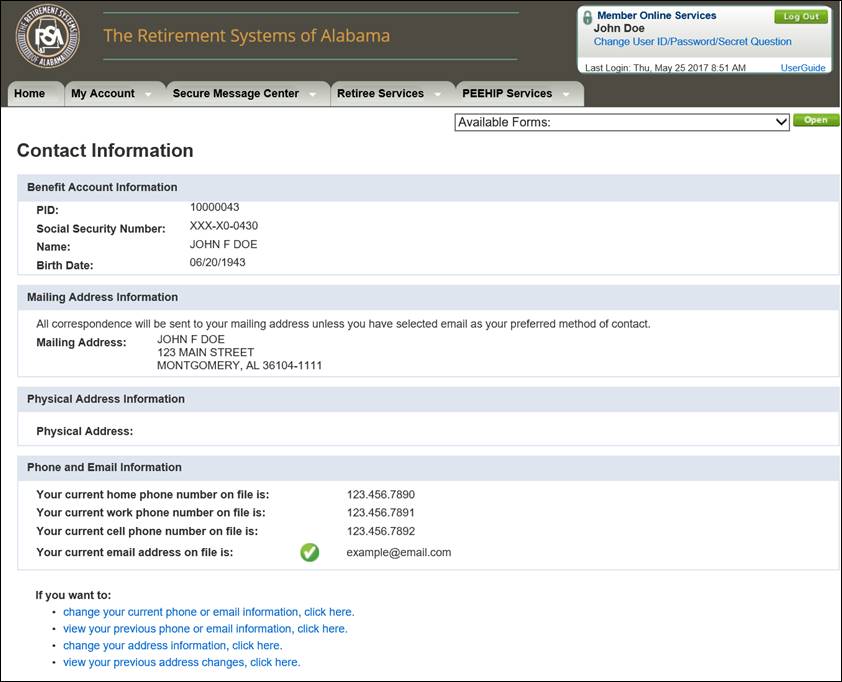

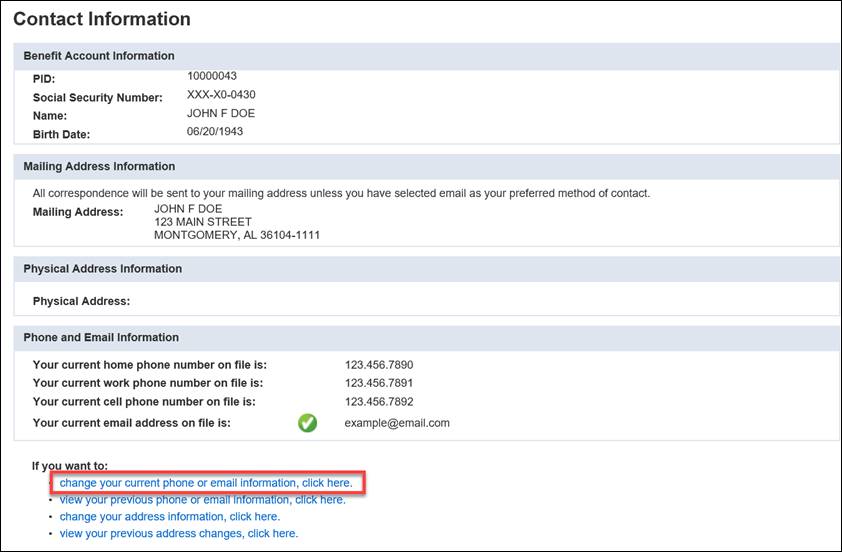

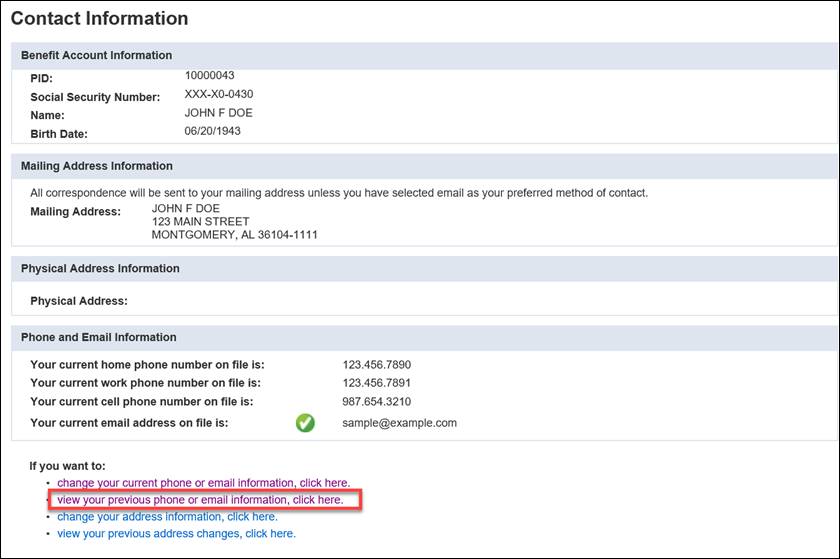

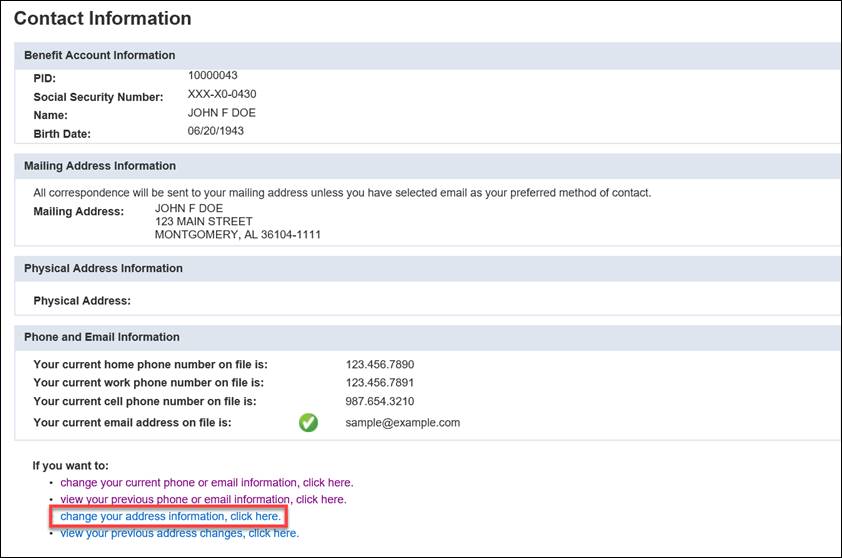

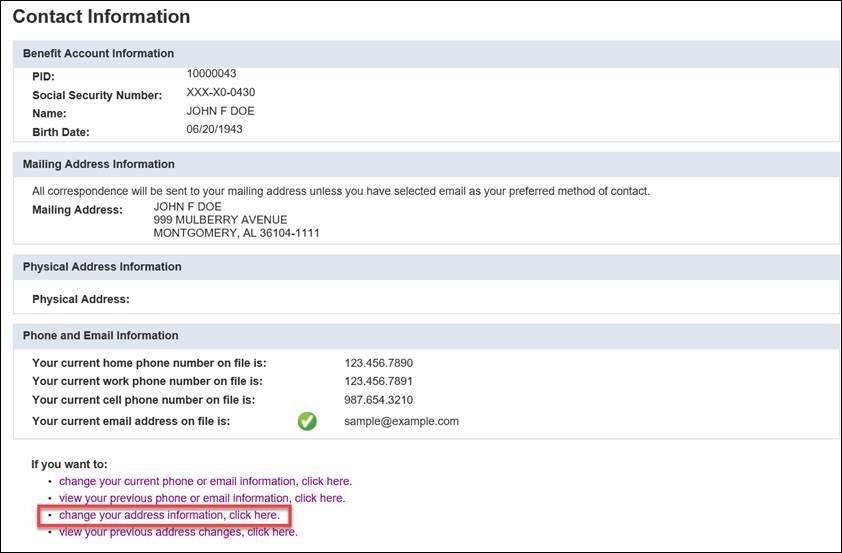

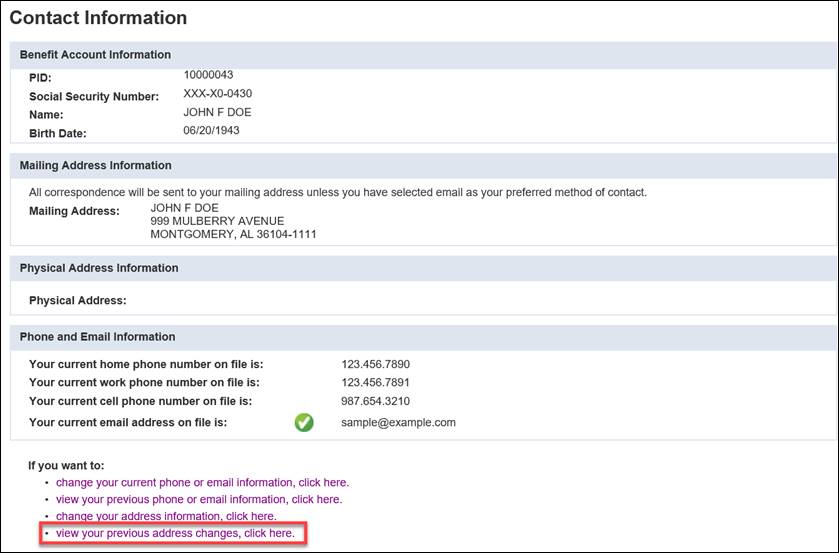

The Contact Information screen displays the contact information, such as address, phone number, or email address that is on record with the RSA.

5.1.1 Navigating to the Contact Information Screen

The following steps describe how to navigate to the Contact Information screen. You must be logged into the MOS website to follow the steps in the sections that follow.

Step 1 -- On the Home screen, either select Contact Information from the My Account drop-down menu or click the Contact Information link.

|

|

Step 2 -- The Contact Information screen displays.

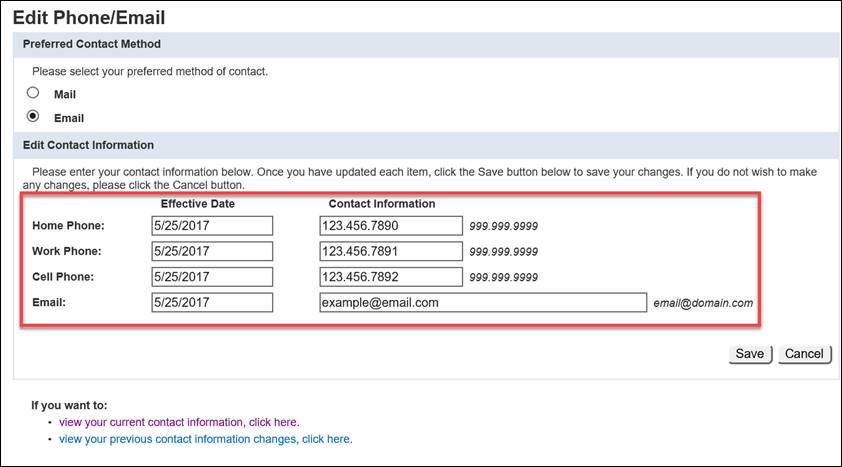

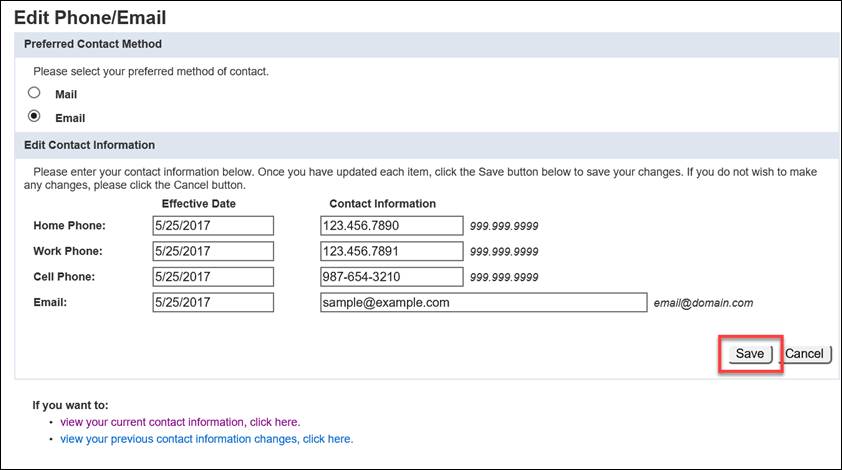

5.1.2 Changing Your Phone Number/Email Address

Follow the directions in the section called Navigating to the Contact Information Screen, then follow the steps below to change your contact information. You must enter all required information on each screen. If you do not enter the required information, you will not be able to successfully change your contact information.

Step 1 -- Click the link called, change your current phone or email information, click here.

Step 2 -- Update your phone number and email information. Enter an effective date. The effective date of the change will automatically default to the current date.

Note: You can also change your Preferred Contact Method. If you choose Email for your preferred method of contact, you will receive all correspondence via email, except your 1099R which is required by federal law to be mailed to your home address.

Step 3 -- Click

![]() .

.

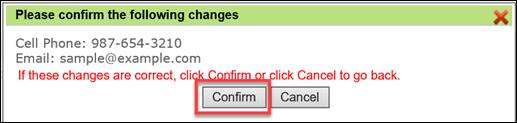

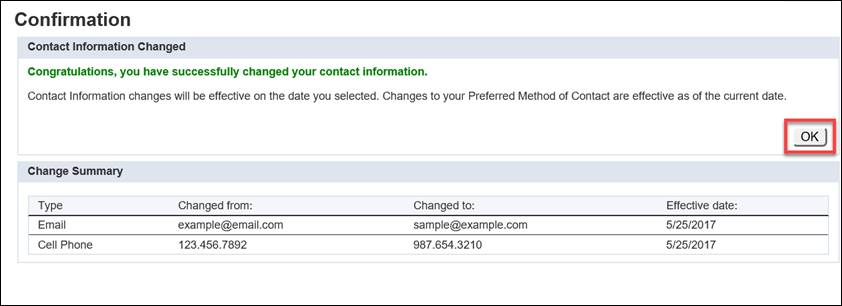

Step

4 -- The

screen that appears confirms the change to your contact information. Click

![]() . An

email correspondence (COR0059: Notification of Change email) is sent to

the member.

. An

email correspondence (COR0059: Notification of Change email) is sent to

the member.

Step 5 -- Click

![]() .

.

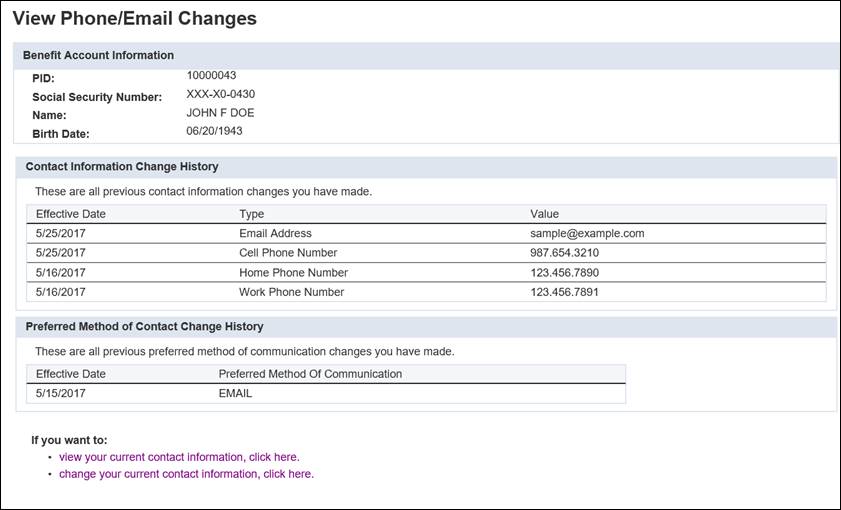

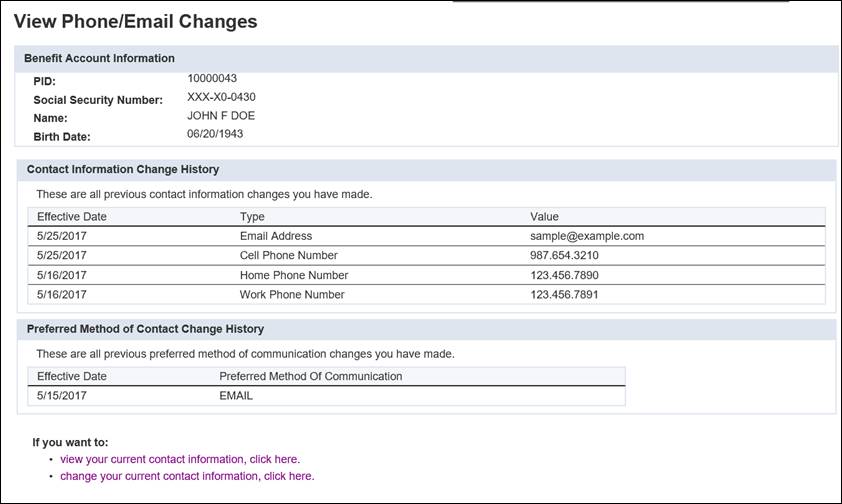

Step 6 -- The View Phone/Email Changes screen displays.

5.1.3 Viewing Previous Email Address/Phone Number Changes

You can view previous changes to your email or phone number using the Contact Information screen. Follow the directions in the section called Navigating to the Contact Information Screen, then follow the steps below to view your previous email or phone number information.

Step 1 -- Click the link called, view your previous phone or email information, click here.

Step 2 -- A history of contact information changes displays. Click the link called, view your current contact information, click here to return to the Contact Information screen.

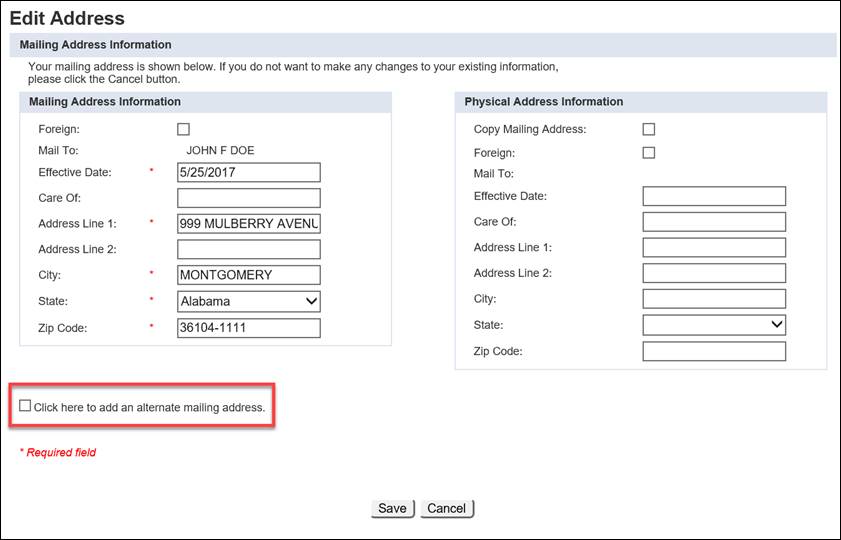

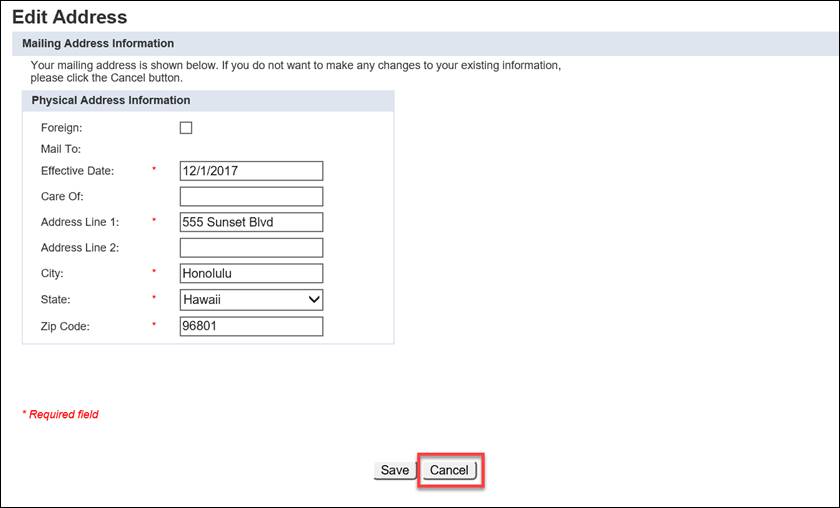

5.1.4 Changing Your Mailing Address

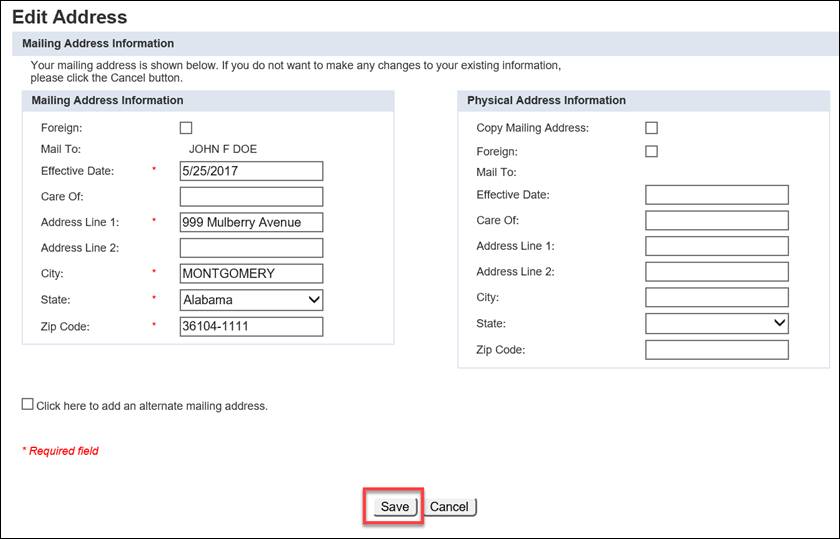

Follow the directions in the section called Navigating to the Contact Information Screen, then follow the steps below to change your mailing address information. You must enter all required information on each screen. If you do not enter required information, you will not be able to successfully change your mailing address information.

Step 1 -- Click the link called, change your address information, click here.

Step 2 -- In the Edit Address screen that appears, enter your new address in the Mailing Address Information section.

Note: If you have a different physical address you can enter it in the Physical Address Information section, or check the box next to Copy Mailing Address if it is the same. Physical address information is not required.

Step 3 -- Click

![]() .

.

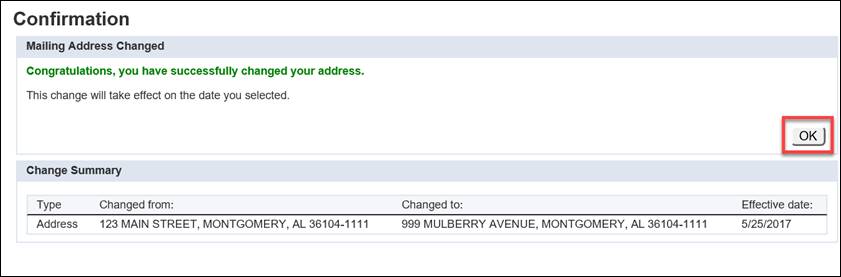

Step 4 -- The

screen that appears displays the change in mailing address. Click ![]() .

.

Step 5 -- Click

![]() .

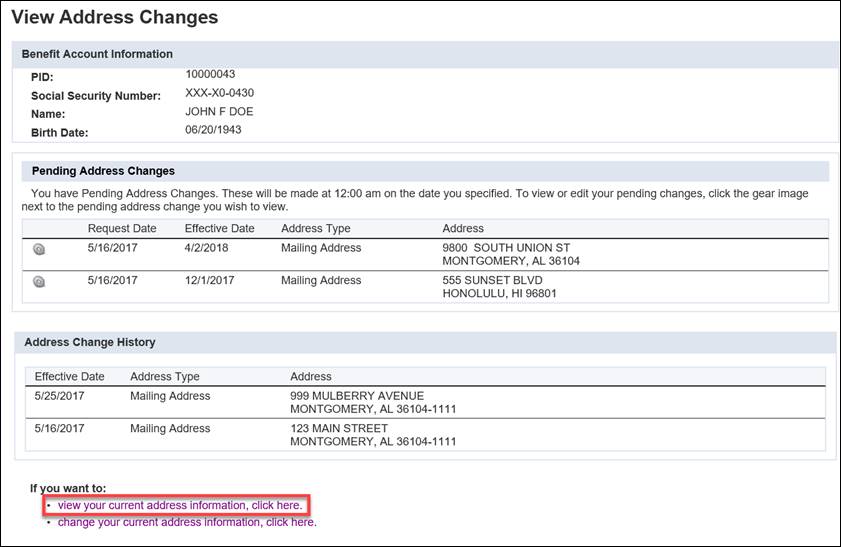

.

Step 6 -- The View Address Changes screen displays. Click the link called, view your current address information, click here to return to the Contact Information screen.

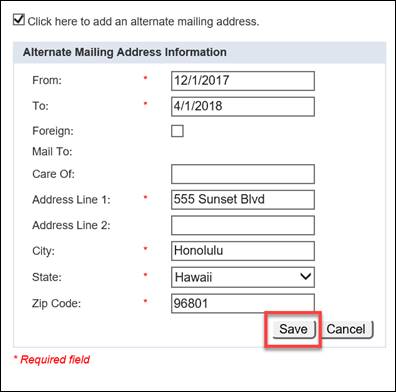

5.1.5 Adding an Alternate Address

An alternate address

is a secondary mailing address that can be used temporarily. For

example, if you often live at a different residence for several months

per year, an alternate address should be on record with the RSA.

Follow the directions in the section called

Navigating to the Contact Information

Screen, then follow the

below steps below to provide an alternate address. You

must enter all required information on each screen. If you do not

enter required information, you will not be able to successfully add an

alternate address.

Step 1 -- Click the link called, change your address information, click here.

Step 2 -- Select the checkbox called, Click here to add an alternate mailing address.

Step 3 -- Enter

your alternate address in the Alternate Mailing Address Information

section. Click ![]() .

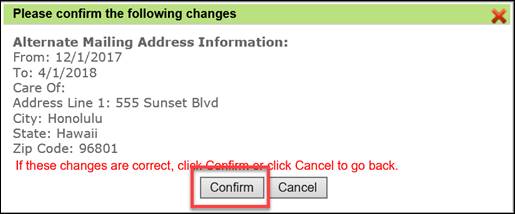

.

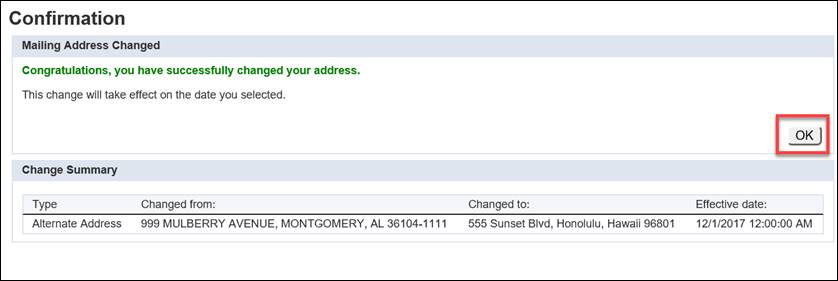

Step 4 -- The

screen that appears confirms the addition of your alternate mailing address.

Click ![]() .

.

Step 5 -- Click

![]() to

view your pending address changes.

to

view your pending address changes.

Step 6 -- The View Address Changes screen displays. Click the link called, view your current address information, click here to return to the Contact Information screen.

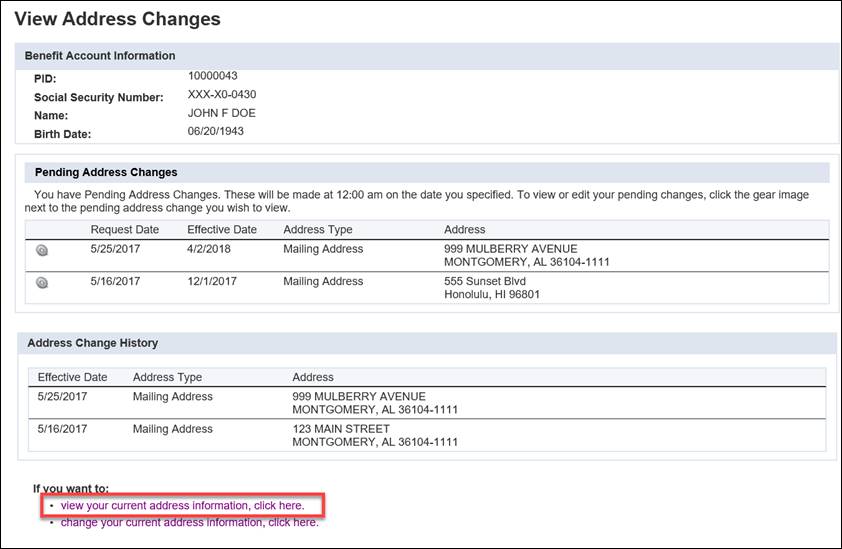

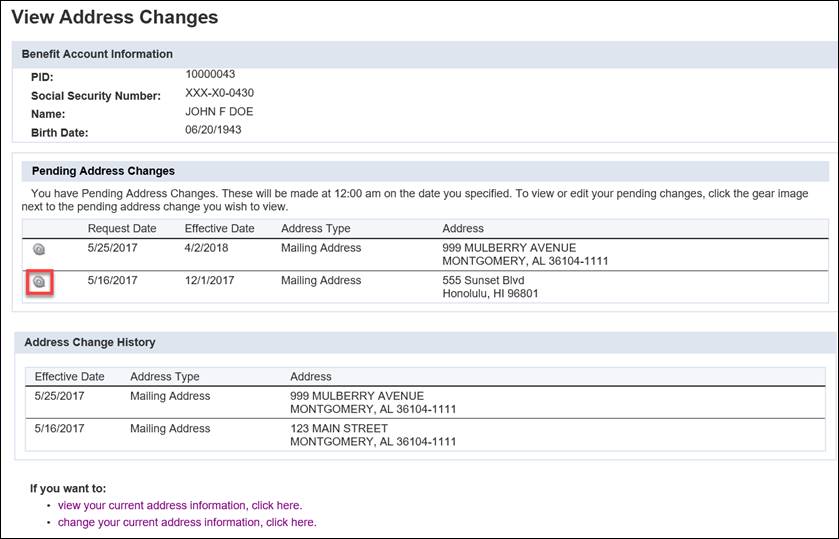

You can view and edit your address changes using the Contact Information screen. This screen shows previous address changes as well as future address changes. You can only edit future dated addresses. Follow the directions in the section called Navigating to the Contact Information Screen, then follow the steps below to view the address changes.

Step 1 -- Click the link called, view your previous address changes, click here.

Step

2 -- The

screen that appears displays your benefit account information and pending

address changes. Click ![]() to make any edits.

to make any edits.

Step

3 -- The

Edit Address screen displays with the changes made for that address

change. You can make changes, then click ![]() or

click

or

click ![]() ,

which returns you to the Contact Information screen.

,

which returns you to the Contact Information screen.

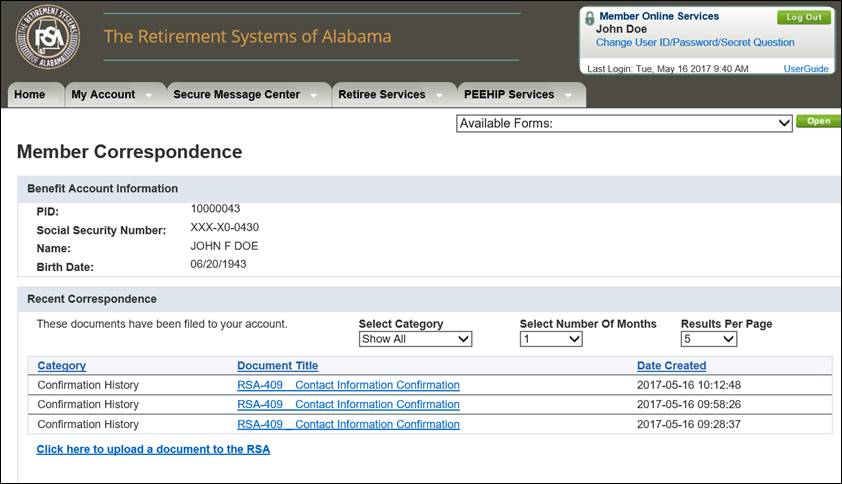

The Member Correspondence screen allows you to view a list of documents, such as verification of retirement benefit or change in beneficiary, that have been received by RSA. You can view a list of correspondence sent or received by the RSA one, three, six, nine, or all months ago.

5.2.1 Navigating to the Member Correspondence Screen

The following steps describe how to navigate to the Member Correspondence screen. You must be logged into the MOS website to follow the steps in the sections that follow.

Step 1 -- On the Home screen, either select Member Correspondence from the My Account drop-down menu or click the Member Correspondence link.

|

|

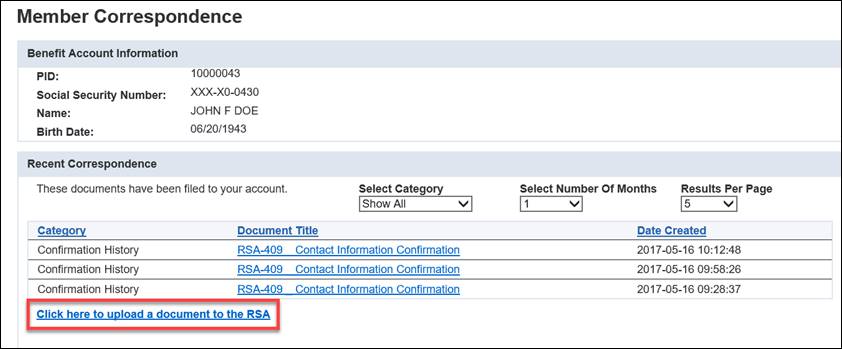

Step 2 -- The Member Correspondence screen displays.

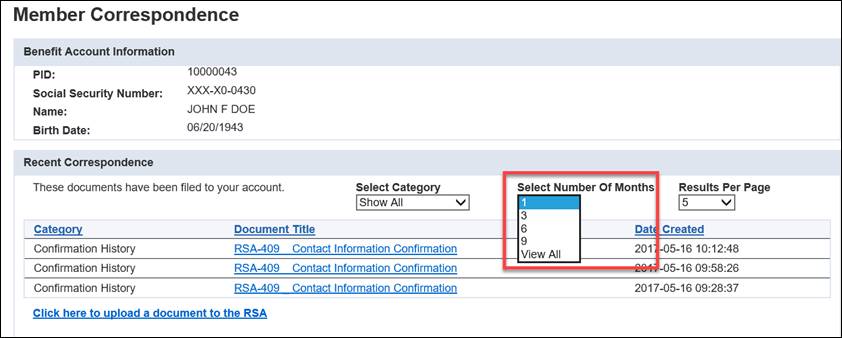

5.2.2 Viewing Available Information about Member Correspondence

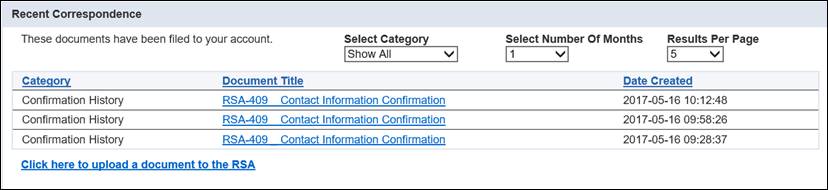

From the Member Correspondence screen, you are able to see a list of forms and correspondence that have been filed to your account based on the number of months you select from the drop-down.

The Benefit Account Information section shows basic information regarding the benefit being received, including your PID, partial Social Security Number, name, and birth date.

The Recent Correspondence section displays any documents that the RSA has on record for you. Clicking the linked under the Document Title column will open a PDF image of the document for viewing.

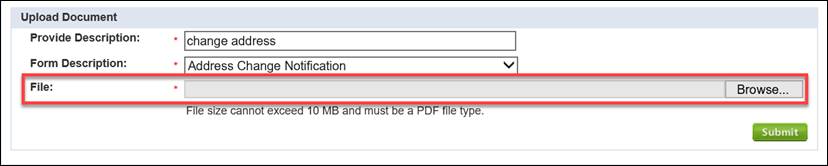

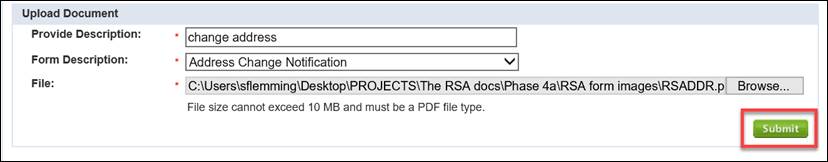

5.2.3 Uploading Documents to the RSA

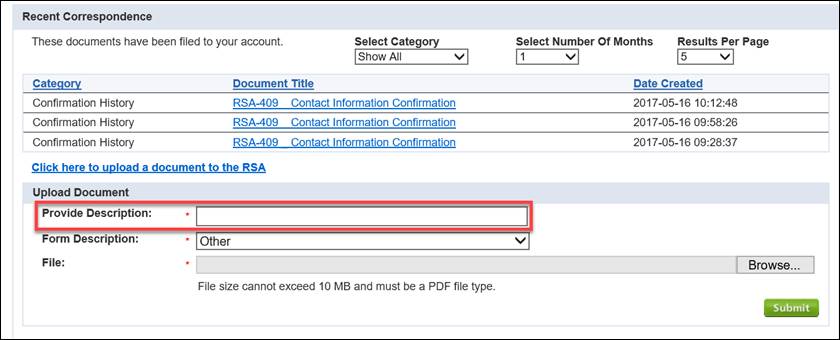

Retirees have the ability to upload documents which need to be transmitted to the RSA. Only PDF files are allowed to be uploaded.

Step 1 -- Click the link called, Click here to upload a document to the RSA.

Step 2 -- Enter a description for the document in the Provide Description field.

Step 3 -- Select a form type from the Form Description field. If you don’t know the type of form to pick, select Other.

Note: If you select Other, the document will be sent unindexed so that the RSA can index it as the correct document.

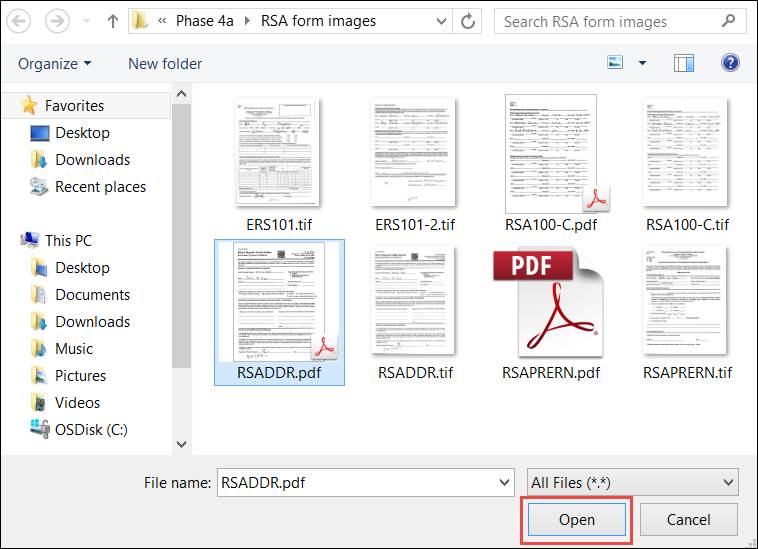

Step 4 -- In

the File field, select the document you want to upload by clicking

![]() .

.

Step 5 -- Select

a file to upload from your computer and click ![]() .

.

Step 6 -- Click

![]() .

.

Step

7 -- The

document gets uploaded to the RSA FileNet repository. You will see a message

that the file was received. Click ![]() .

.

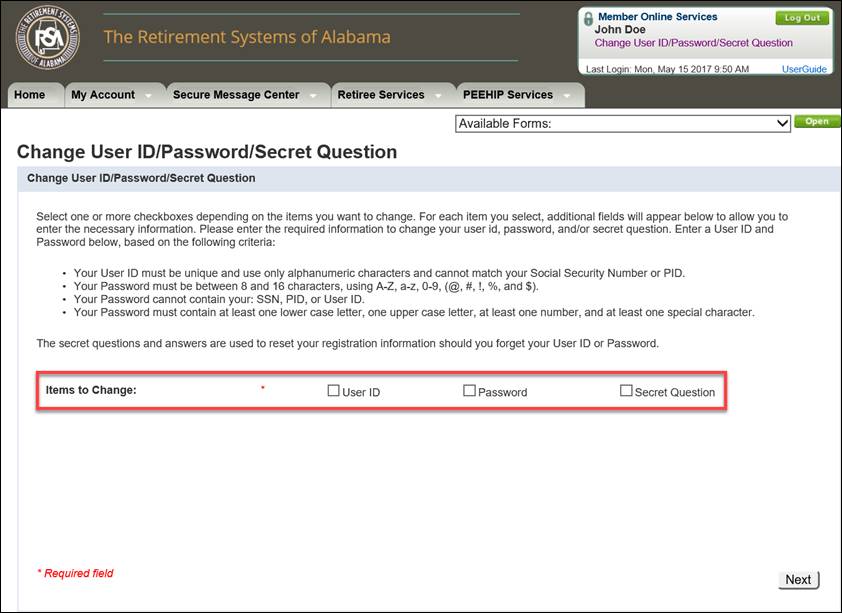

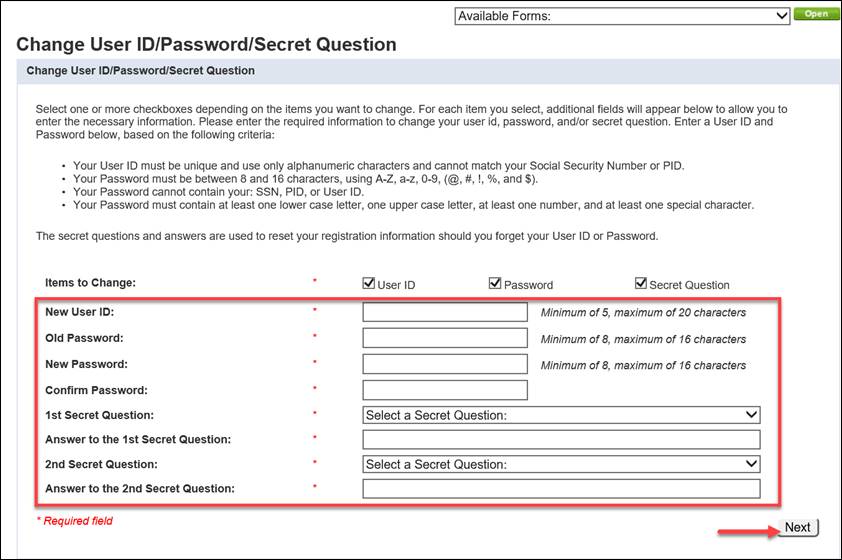

5.3 Change User ID/Password/Secret Question

If you want to change your User ID, Password, or Secret Questions, you can do so from a link on the Member Online Services (MOS) Home page (or using the navigation menu). You must enter all required information on each screen. If you do not enter the required information, you will not be able to successfully change your User ID, Password, or Secret Questions.

Step 1 -- On the Home screen, either select Change User ID/Password/Secret Question from the My Account drop-down menu or click the Change User ID/Password/Secret Question link from the upper-right corner of the screen below your name.

|

|

Step 2 -- Select the checkbox for the items you want to change. You can select multiple checkboxes to change more than one item.

Step 3 -- Enter the required information. The required information changes based on the selection(s) made in the previous step.

· If you select the User ID checkbox, enter a new User ID

· If you select the Password checkbox, enter the old Password, new Password, and confirm the new Password

· If you select Secret Question checkbox, select a question from the drop-down menu for your first and second question, then enter an answer to each

· Click ![]()

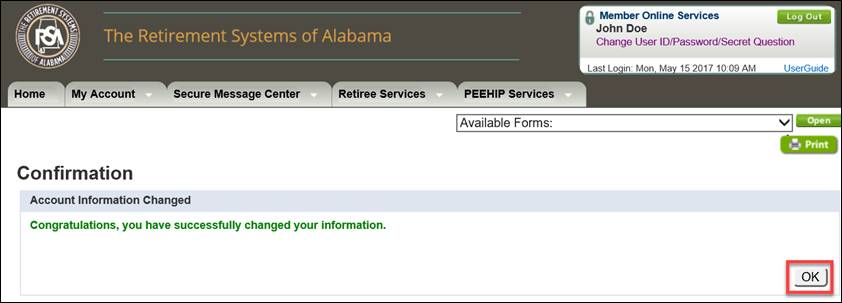

Step 4 -- The

screen that appears confirms your changes. Click ![]() to

return to the Home screen.

to

return to the Home screen.

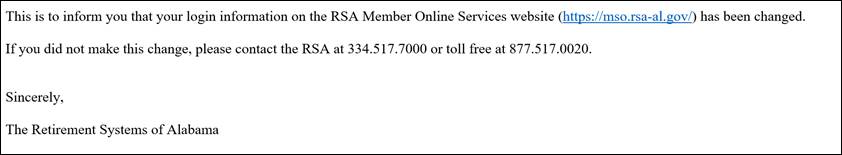

Note: A Login Change Notification email is sent to the member.

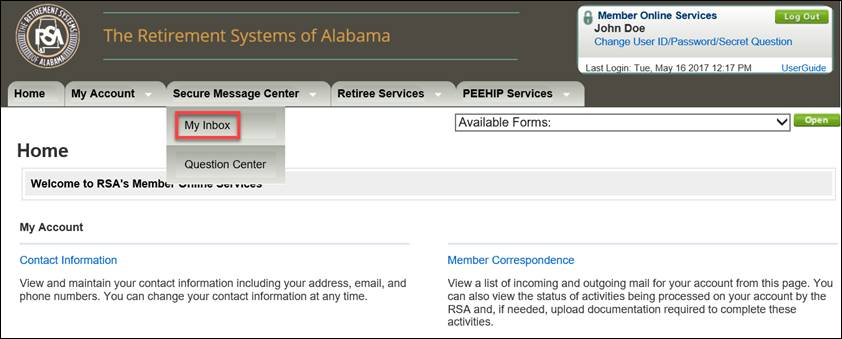

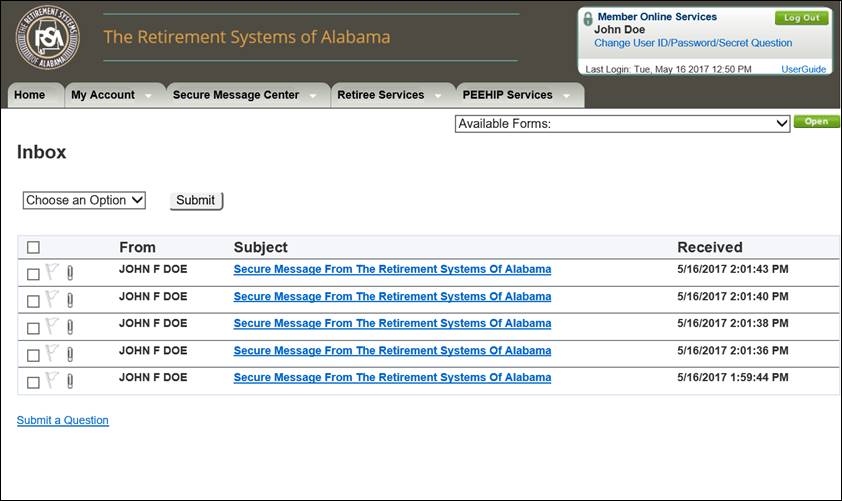

The Secure Message Center provides a mechanism for the RSA to communicate electronically and securely with the registered member in the Member Online Services Portal.

You must be logged into the MOS website to follow the steps below:

Step 1 -- From any screen, select My Inbox from the Secure Message Center drop-down menu.

Step 2 -- The Inbox screen displays.

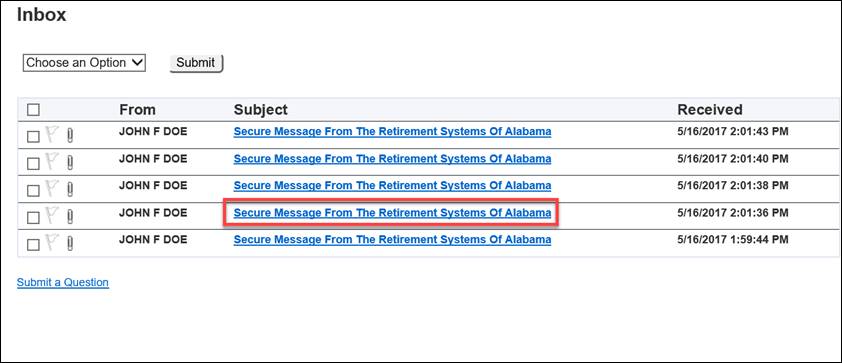

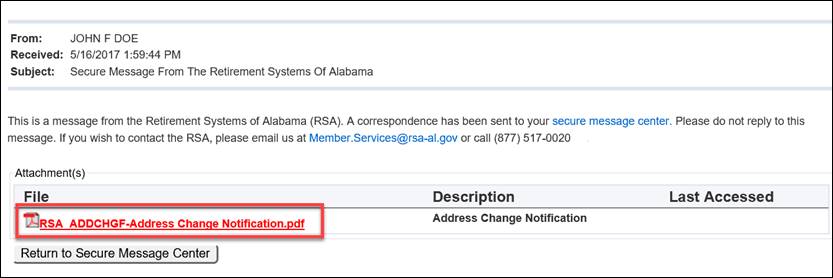

Step 3 -- Select a message to read by clicking on the link in the Subject column.

Step 4 -- The Message Details screen displays. If there is an attachment, you can view it by clicking on the link in the File column.

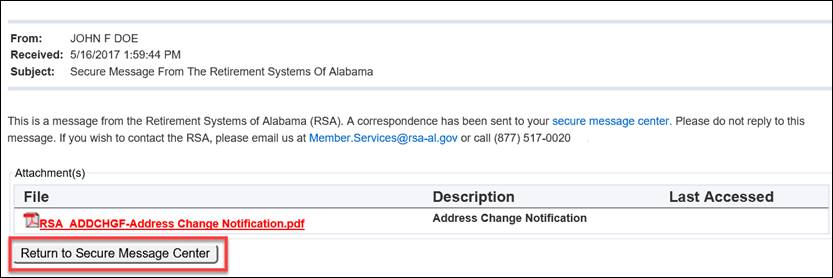

Step 5 -- Click

![]() to

return to your Inbox.

to

return to your Inbox.

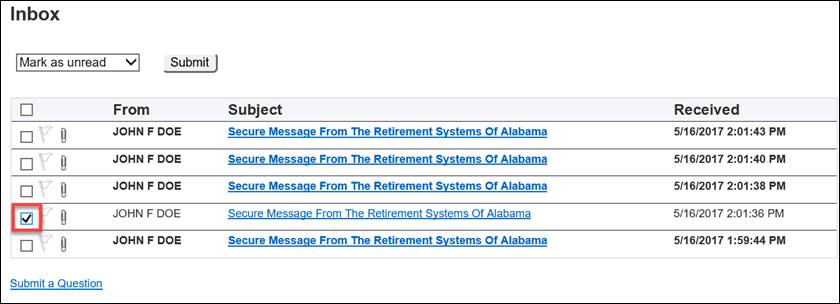

Step 6 -- Select a message by clicking the checkbox.

Note: If you select the box in the column header, it will select all messages.

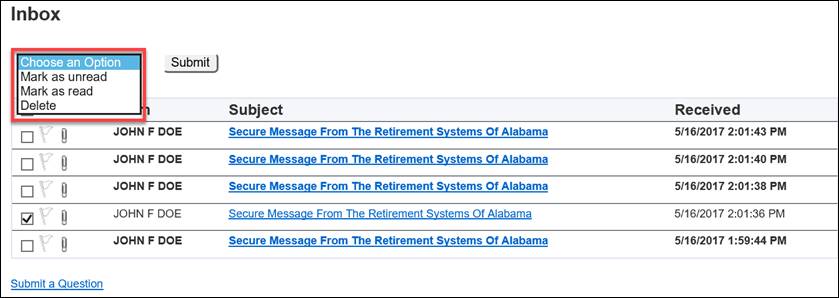

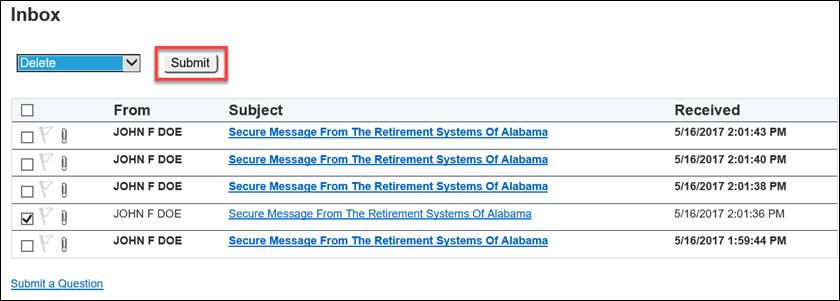

Step 7 -- Click the Choose an Option drop-down menu to mark a message as Unread, Read, or Delete.

Step 8 -- Click

![]() .

.

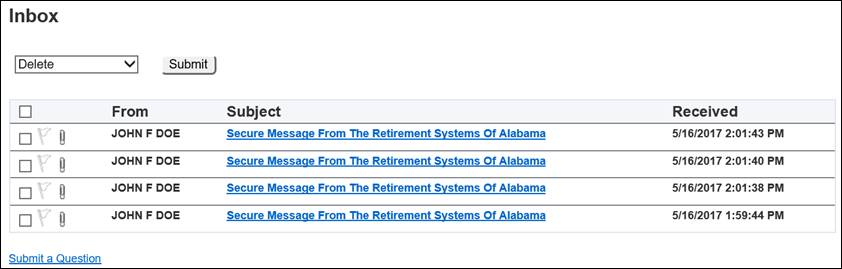

Step 9 -- The email message is removed from the display of your Inbox.

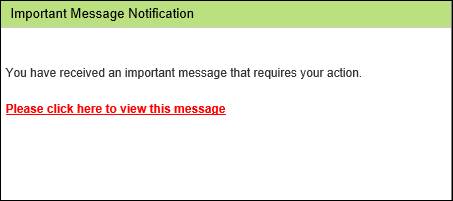

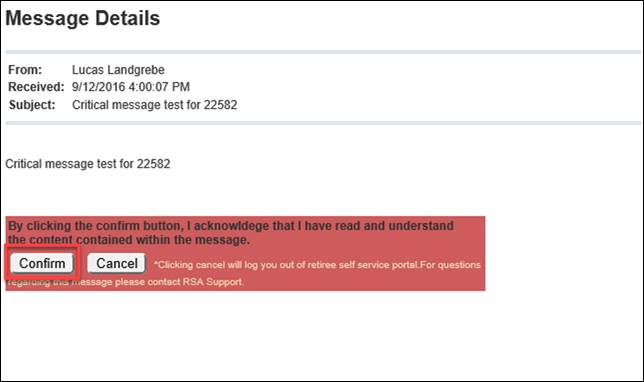

Critical messages are used by the RSA to send out important information (i.e. open enrollment communications) to members. When a critical message is sent, a small window appears after you log in. You need to click the red link to view the message.

After clicking the link, you have the option of confirming you read the message or canceling. Confirming allows you to access the self-service site. Cancelling will log you out of MOS. You will not be able to access anything in self-service until you have confirmed you have read the critical message.

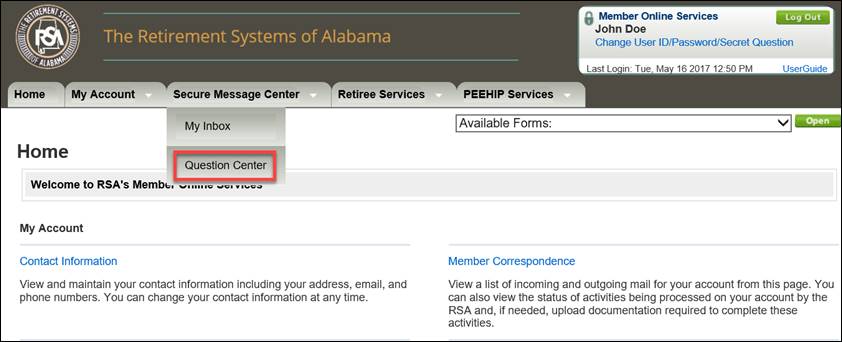

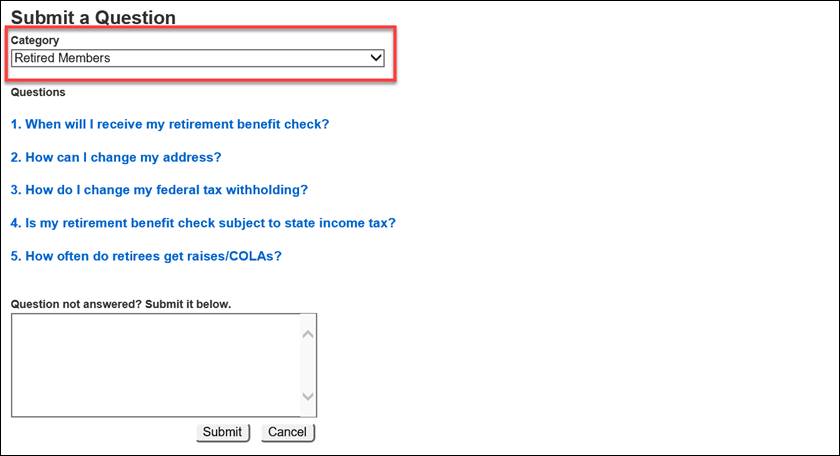

The Submit a Question functionality provides a mechanism for a Retiree to submit a question electronically and securely and gives the RSA the ability to view and respond to submitted questions.

You must be logged into the MOS website to follow the steps below:

Step 1 -- From any screen, select Question Center from the Secure Message Center drop-down menu.

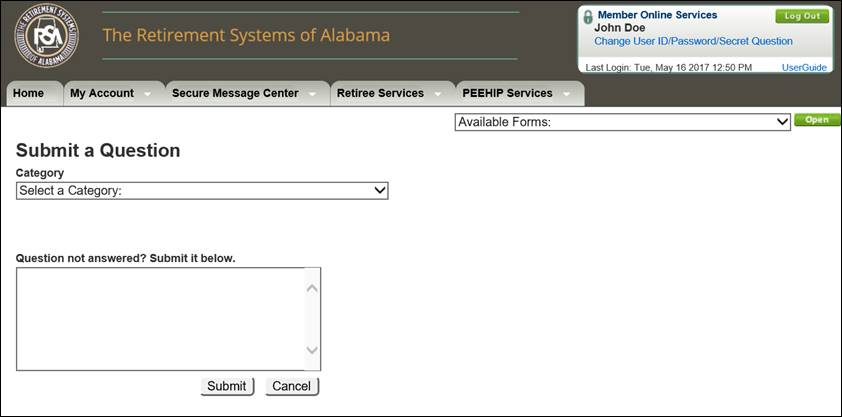

Step 2 -- The Submit a Question screen displays.

Step 3 -- The Submit a Question screen allows you to select a category for the question. Select a category from the Category drop-down menu. The list of questions associated with that category are displayed.

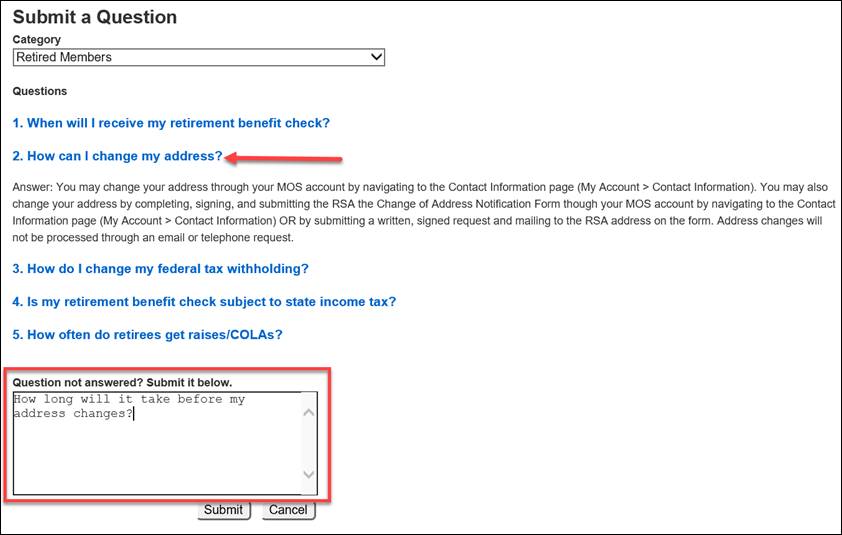

Step

4 -- Click

on the question to display an answer. If you need to continue because

your question is not answered, you can submit a freeform question by typing

in the Question not answered? Submit it below field. Then

click ![]() .

.

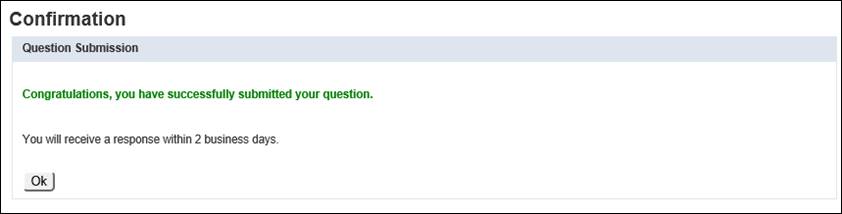

Step 5 -- You will receive a confirmation message that the question was submitted. A representative from the RSA can then respond with an answer through a communication using CRM. Follow the steps in the section titled, Secure Message Center to view the response.

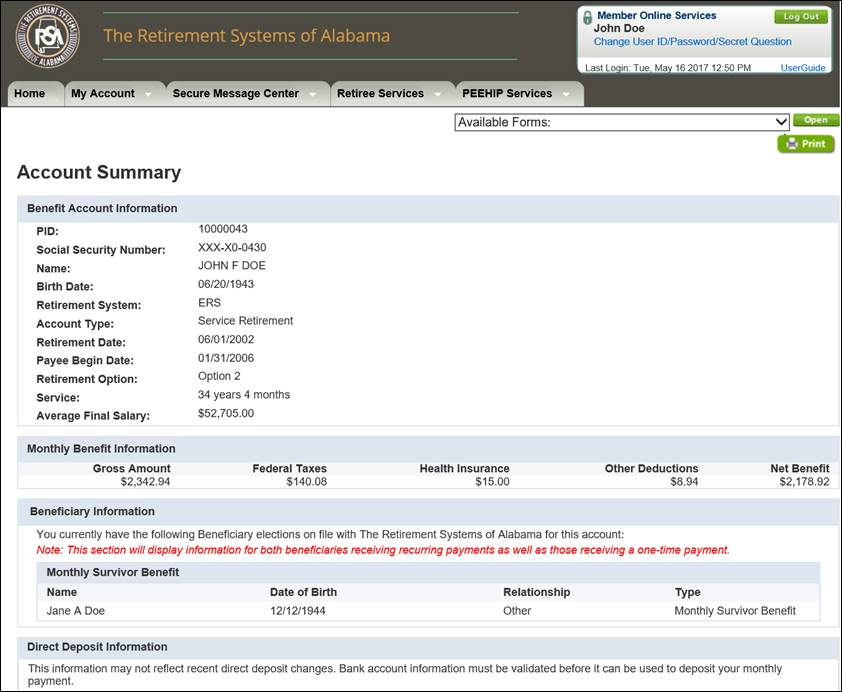

From the Account Summary screen, you can view your benefit account information, monthly benefit information, beneficiary information, direct deposit information, IRS tax withholding information, and deduction information.

The following steps describe how to navigate to the Account Summary screen. You must be logged into the MOS website to follow the steps in the sections that follow.

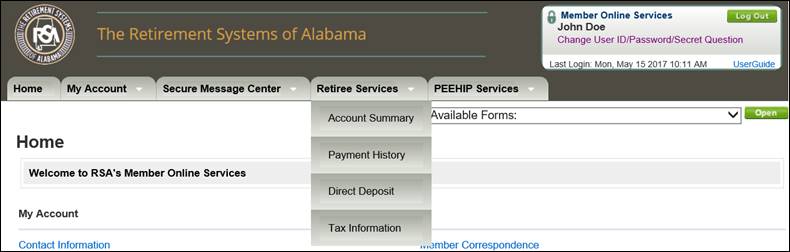

Step 1 -- On the Home screen, either select Account Summary from the My Account drop-down menu or click the Account Summary link.

|

|

Step 2 -- The Account Summary screen displays. You are able to view specific information regarding benefits that you are receiving. You are also able to change and update your tax withholdings and direct deposit information.

Note: If you have more than one benefit account with the RSA, all of the benefit accounts will be displayed under the Benefit Account Information section.

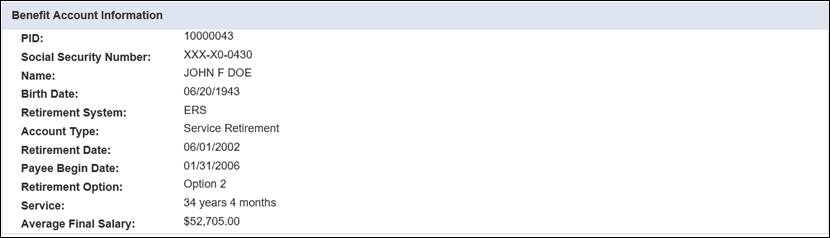

The Benefit Account Information section

shows basic information regarding the benefit being received including

your PID, the retirement system from which the benefit is paid, the type

of account, the account effective date, your retirement option, total

years of service, and average final salary.

The Monthly Benefit Information section shows the gross and net amount of the benefit, along with the amounts that are being deducted. If changes are made to any of the deductions (by RSA), the net amount of the benefit received would be recalculated and display the correct amounts in real-time.

![]()

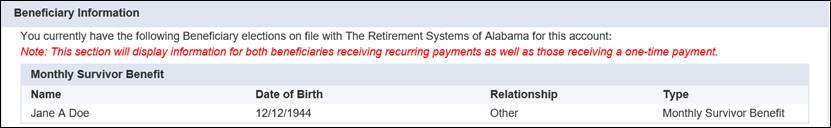

The Beneficiary Information section displays all types of beneficiaries including monthly benefit beneficiaries as well as one-time payment beneficiaries.

If you have elected to have your benefit direct deposited, the Direct Deposit Information section shows those details.

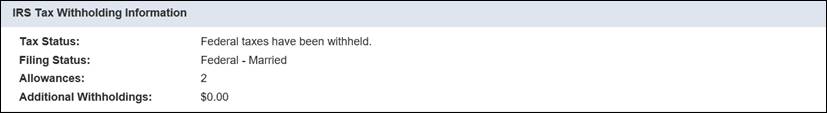

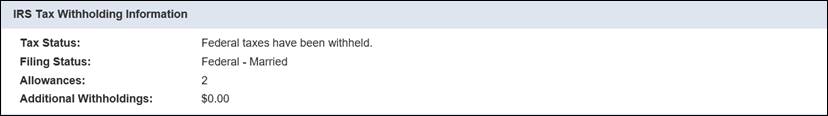

The IRS Tax Withholding Information section shows the federal tax information for the benefit. You will be able to change your tax elections by clicking on the link, change your tax information click here.

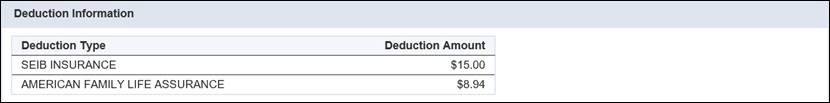

If there are any other deductions being withheld from the benefit, they display in the Deduction Information section.

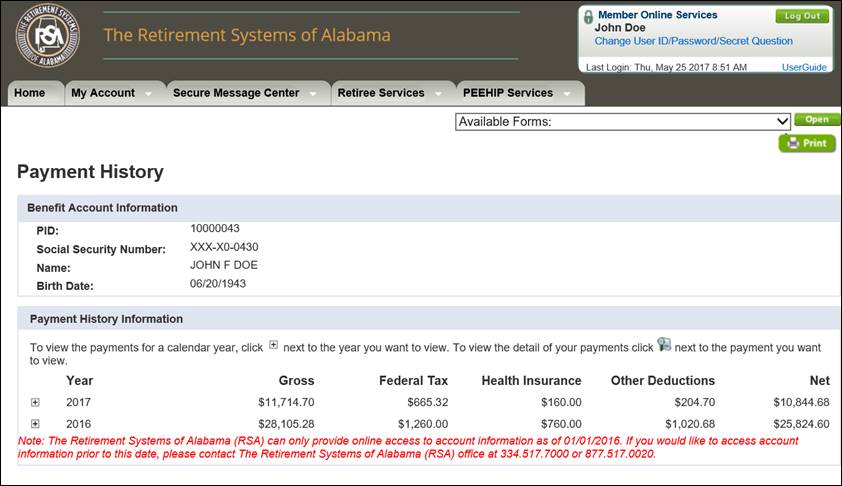

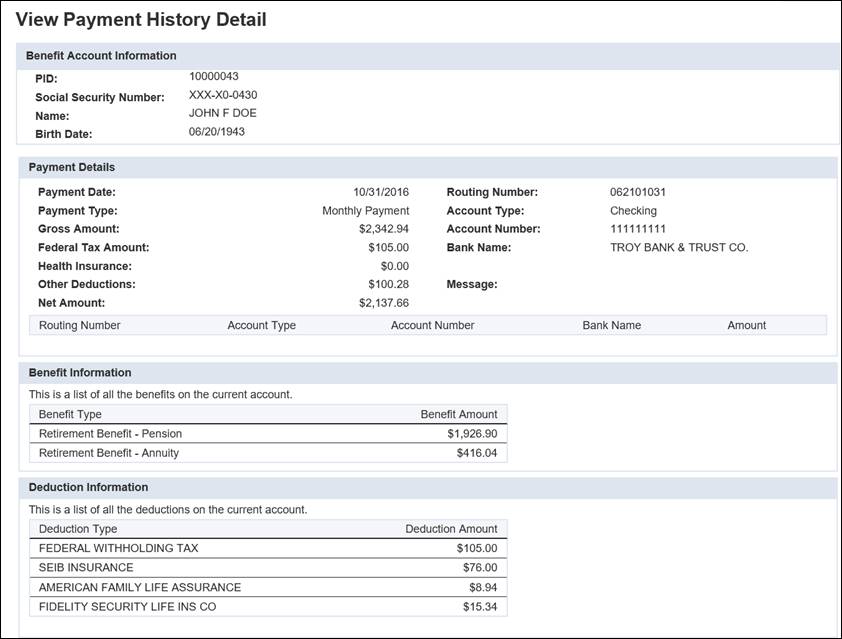

The Payment History screen shows information regarding the benefit that you are receiving. From this screen, you can view information on individual payments that you have received in the past, along with the amount of deductions and taxes that were withheld from the benefit.

The following steps describe how to navigate to the Payment History screen. You must be logged into the MOS website to follow the steps below.

Step 1 -- On the Home screen, either select Payment History from the My Account drop-down menu or click the Payment History link.

|

|

Step 2 -- The Payment History screen displays.

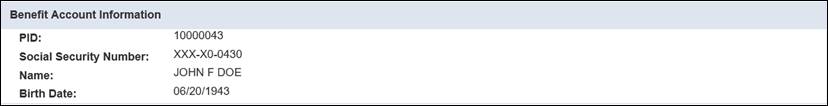

The Benefit Account Information section shows the basic information regarding the benefit being received. Here you see your PID, partial Social Security Number, name, and birth date.

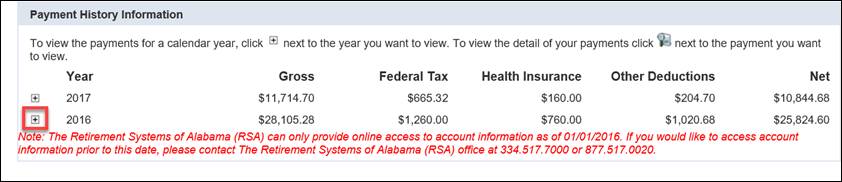

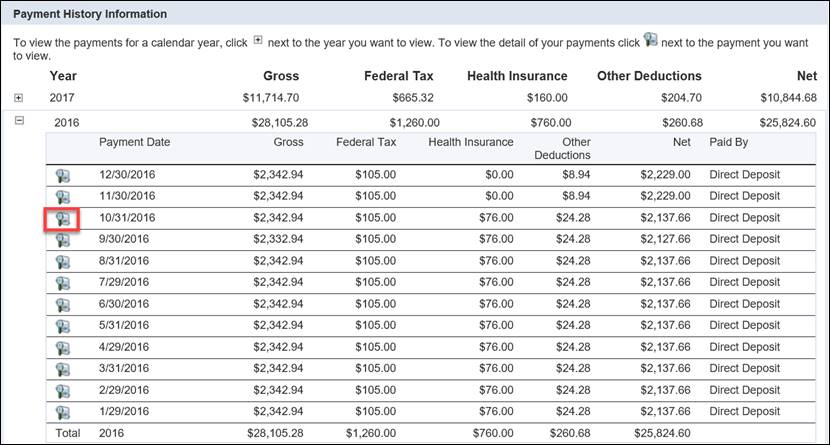

The Payment History Information section

of this screen shows a summary of the benefits that you have received

broken down by year. To view individual payments received, click ![]() next

to the year you would like to view. This expands the year section to show

all benefits that were received during that year.

next

to the year you would like to view. This expands the year section to show

all benefits that were received during that year.

To view more specific information on an individual

payment that has been received, click ![]() next

to the payment that you would like to view.

next

to the payment that you would like to view.

This displays another screen that shows you more detailed information on that benefit payment.

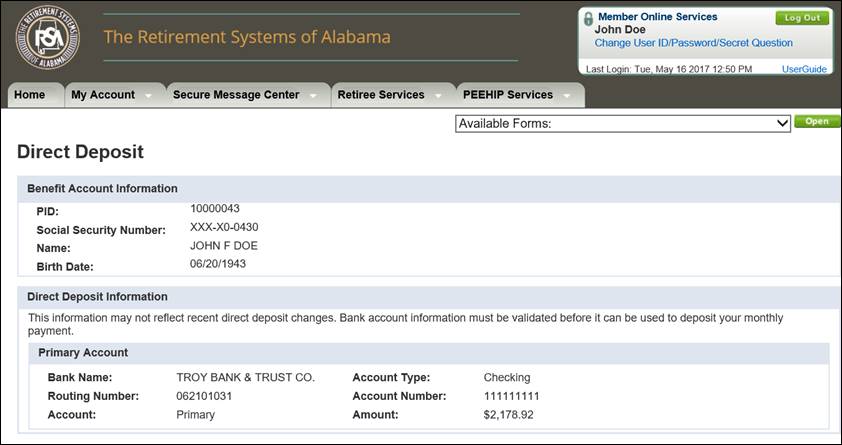

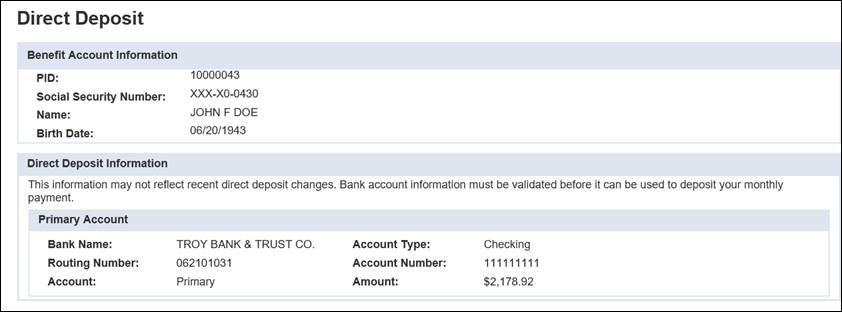

The Direct Deposit screen shows information such as account type, bank routing number, and bank account number of the bank that is currently on record with the RSA for the direct deposit of your benefit payment.

7.3.1 Navigating to the Direct Deposit Screen

The following steps describe how to navigate to the Direct Deposit screen. You must be logged into the MOS website to follow the steps in the sections that follow.

Step 1 -- On the Home screen, either select Direct Deposit from the My Account drop-down menu or click the Direct Deposit link.

|

|

Step 2 -- The Direct Deposit screen displays.

7.3.2 Viewing Your Direct Deposit Information

From the Direct Deposit screen, you can view the direct deposit information that is currently on record with the RSA for your benefit account(s).

The Benefit Account Information section of the screen shows the basic information regarding the benefit being received, including your PID, partial Social Security Number, name, and birth date.

If you have elected to have your benefit direct deposited, the Direct Deposit Information section shows the information for the bank where the benefit is deposited.

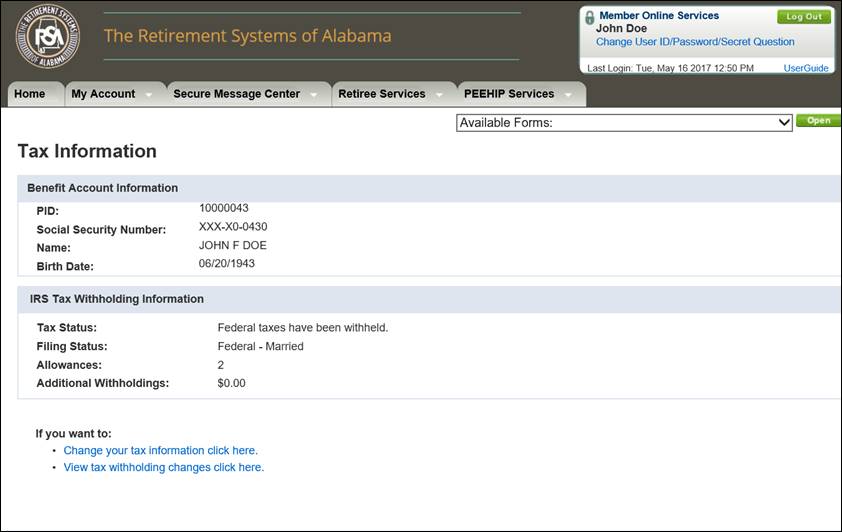

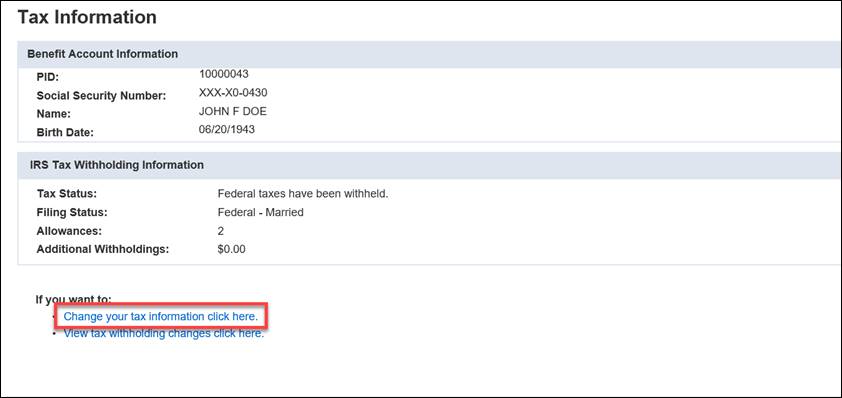

The Tax Information screen summarizes the federal taxes currently withheld from your benefit. On this screen, you can estimate how different withholdings change your net benefit amount. You can view and change your tax withholdings from this screen.

7.4.1 Navigating to the Tax Information Screen

The following steps describe how to navigate to the Tax Information screen. You must be logged into the MOS website to follow the steps in the sections that follow.

Step 1 -- On the Home screen, either select Tax Information from the My Account drop-down menu or click the Tax Information link.

|

|

Step 2 -- The Tax Information screen displays.

7.4.2 Viewing the Tax Information Screen

The Benefit Account Information section shows basic information regarding your benefit, including your PID, partial Social Security Number, name, and birth date.

The IRS Tax Withholding Information section shows your current IRS tax details.

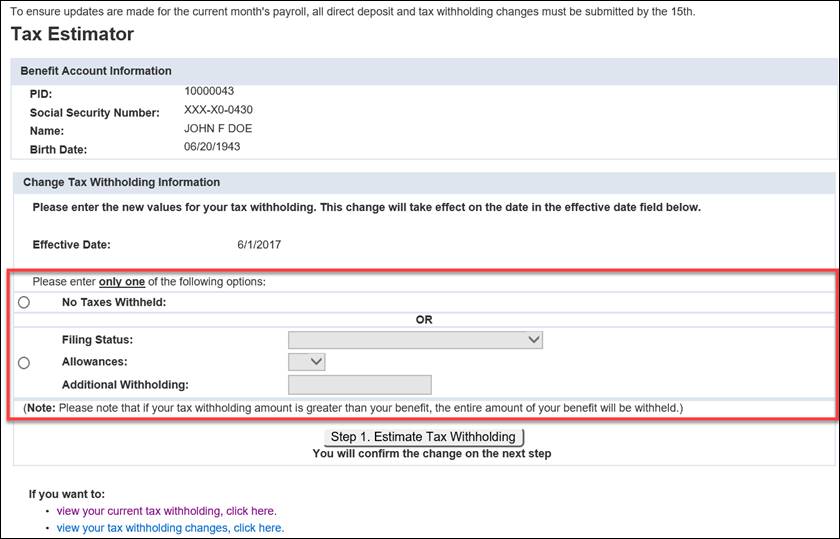

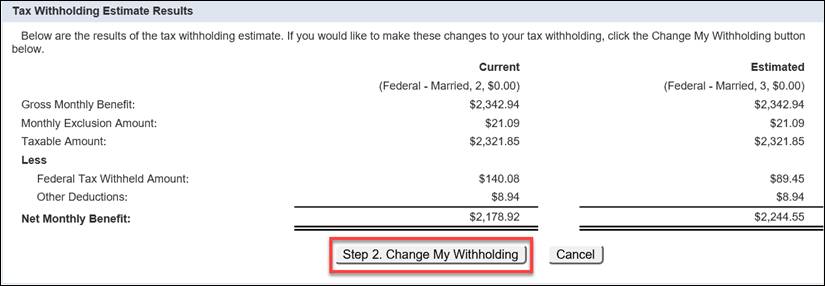

7.4.3 Changing Your Tax Withholdings

Using the Tax Information screen, you can change your tax withholdings. If you receive payments from multiple benefit accounts and wish to change the withholdings in each of them, you must do so individually.

Follow the directions in the section called

Navigating to the Tax Information Screen, then follow the steps

below to change your tax withholdings. You must

enter all required information on each screen. If you do not enter

the required information, you will not be able to successfully change

your tax withholdings.

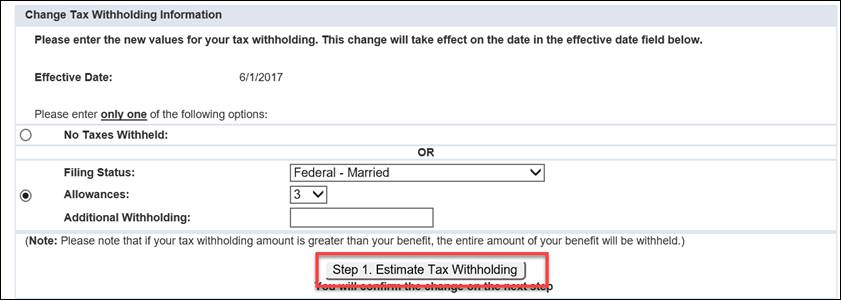

Step 1 -- Click the link called, Change your tax information click here.

Step 2 -- Enter your new tax details, such as no taxes withheld, filing status (i.e., Federal – Married, Federal – Single, Married, but withhold at higher single rate), allowances, additional withholding, or percentage.

Note: You must select the radio button before entering information.

Step

3 -- Click

![]() to

see how your benefit payment will change based on your selection.

to

see how your benefit payment will change based on your selection.

Note: Your tax withholding information will not change when you click this button. You will confirm the change on the next screen.

Step 4 -- Your tax withholding estimate results display. Compare the current and estimated withholdings and the effect the new withholdings have on your monthly benefit amount.

Step

5 -- To

accept the change to your tax withholdings based on the estimate, click

![]() . If

you do not want to change the tax withholdings as shown, click

. If

you do not want to change the tax withholdings as shown, click ![]() .

.

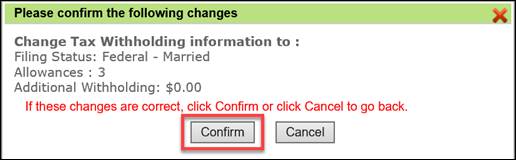

Step 6 -- The

screen that appears confirms the changes to your tax withholdings. Click

![]() .

.

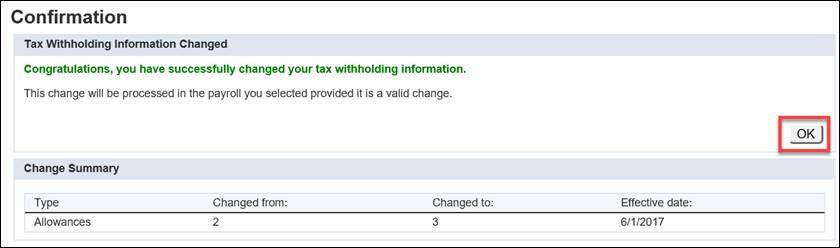

Step 7 -- A

Confirmation screen displays. Click ![]() to

return to the view your tax withholding changes page.

to

return to the view your tax withholding changes page.

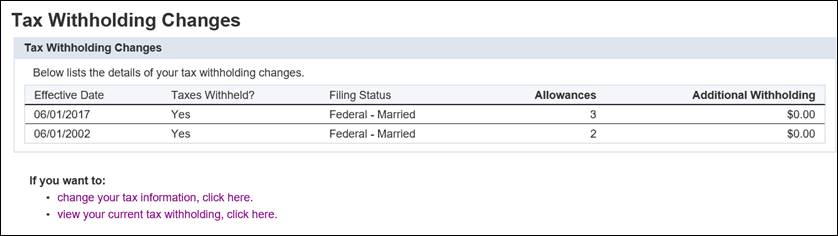

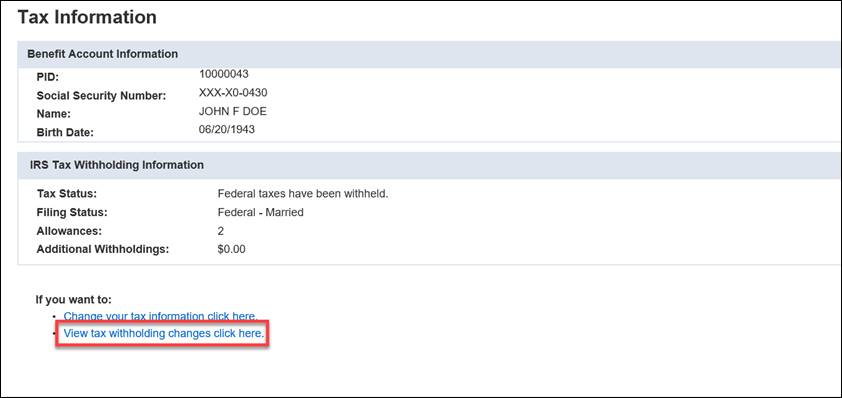

7.4.4 Viewing Tax Withholding Changes

Follow the directions in the section called Navigating to the Tax Information Screen, then follow the steps below to view your tax withholding changes.

Step 1 -- Click the link called, View tax withholding changes click here.

Step 2 -- The Tax Withholding Changes screen displays current withholding information.